Climate change poses massive risks to people and businesses, and governments are attempting to control it through regulations that limit carbon emissions. Taking cognisance of this developing dynamic, the European Union introduced the Carbon Border Adjustment Mechanism (CBAM) in May 2023 to promote fair competition and manage carbon footprints. This mechanism ensures importers and non-EU operators bring products into the EU market that comply with carbon regulations.

Read along to find out what CBAM is, why it matters to you, and how it can impact your businesses if you export or import your products into the EU.

What is CBAM?

CBAM stands for Carbon Border Adjustment Mechanism. It is the EU’s tool to put a fair price on the Carbon emitted during the production of Carbon-intensive goods produced outside the EU that are entering the EU’s markets for trade. Designed in line with the World Trade Organization (WTO) rules, it was created to encourage cleaner industrial production in non-EU countries. This is the world’s first carbon border tariff imposed on imports of carbon-intensive products entering the EU market from non-EU countries.

CBAM was introduced to force organizations to cut carbon emissions, facilitate pay parity, and reduce the carbon footprint left by corporations and businesses in the EU and other countries through carbon regulations.

The need for CBAM reporting arose because the EU has stringent carbon regulations under the ETS (Emissions Trading System), which limit carbon-intensive product production. However, products from nations with fewer or no carbon regulations disrupted the EU market due to their lower prices, leading to carbon pricing and tariff disparity. This placed EU operators in a disadvantageous position.

To avoid pricing disparity, EU businesses began shifting their carbon-intensive production to non-EU countries, as many non-EU countries do not have stringent climate change policies. This process of bypassing the carbon regulations in the EU is known as ‘carbon leakage’. CBAM was introduced to resolve unfair competition with non-EU operators and limit the carbon footprint of products entering the EU, thus accelerating the goal of achieving Net Zero targets.

Objectives of CBAM regulation

- Address Carbon Leakage: CBAM was introduced to resolve the challenge of ‘Carbon leakage’ and ensure cleaner industrial production in the EU market and non-EU countries.

- Ensure market parity: CBAM was developed to create a level playing field for all businesses entering the EU through their product imports.

- Carbon neutrality by 2050: CBAM initiative comes under the ‘Fit for 55’ legislative package and aims to meet the objective of making the EU climate-neutral by 2050 in alignment with the Paris Agreement.

- Encourage decarbonisation in third countries: Due to lack of existing decarbonization rules in third countries (a country that is not a member of the European Union as well as a country or territory whose citizens do not enjoy the European Union right to free movement), implementation of CBAM ensures reduced carbon footprint of products.

- Adoption of green technology: CBAM regulations also promote operators from non-EU countries to deploy technologies that are more efficient in reducing Greenhouse Gas emissions (GHG).

- Emission report: Importers are required to submit CBAM certificates for the Carbon emissions before the non-EU operator enters the EU market.

- Quarterly reports: Importers need to submit quarterly Carbon emissions reports which must include details about embedded, direct & indirect Carbon emissions

1. CBAM reporting complements EU ETS

The CBAM was introduced to complement the EU ETS (EU Emissions Trading System), which only applies to European Union countries. EU ETS was introduced so that EU countries could comply with climate change regulations in the European market. While ETS is applicable to European nations, CBAM applies to nations outside the EU.

ETS works on the ‘cap and trade’ principle, where a cap limits the total amount of greenhouse gases that can be emitted by the installations and operators covered by the system. The cap is reduced annually in line with the EU’s climate target, ensuring emissions decrease over time. Since 2005, the EU ETS has helped reduce emissions from power and industry plants by 37 per cent. Carrying forward this vision, CBAM too aims to enforce carbon and emission regulations in the products of non-EU nations.

2. Sectors covered under CBAM

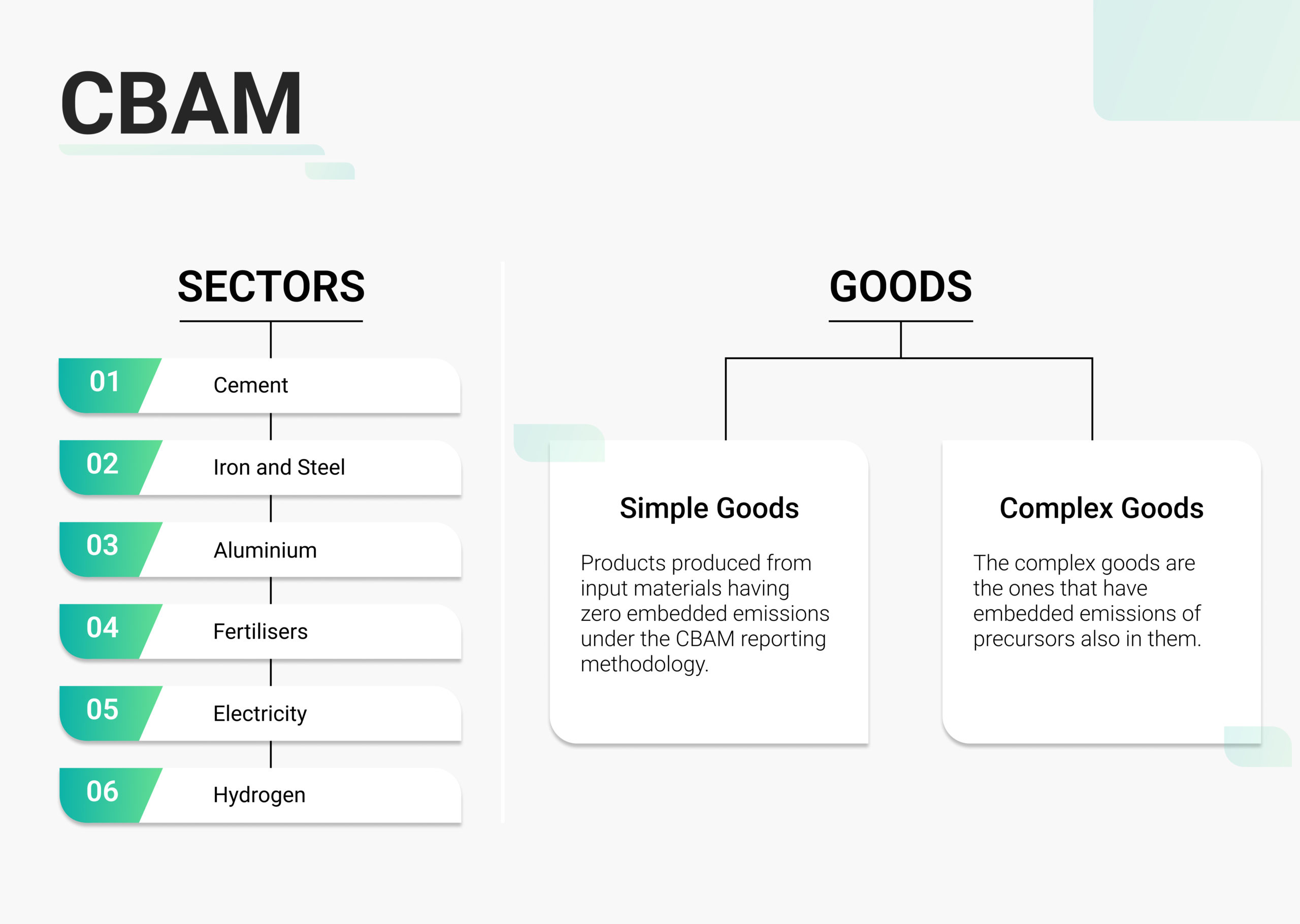

Currently, CBAM regulations are applicable only to sectors whose products pose a greater risk of Carbon leakage and whose production is more Carbon-intensive. During the initial roll-out phase of CBAM, five sectors covered under the CBAM are cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen. The rules and guidelines change under the CBAM for each sector and its products.

Aside from sectors, CBAM also classifies the products of the sectors into two categories depending on their production methods and Carbon emissions:

- Simple Goods: These goods are produced from input materials that have zero embedded emissions under the CBAM reporting methodology. Therefore, the embedded emissions of simple CBAM goods are based entirely on the emissions occurring during their production.

- Complex Goods: Complex goods are the ones that have embedded emissions of precursors also in them (separate CBAM goods that were used during the production of other CBAM products).

The goods are further classified into three types as per sources of Carbon emissions. These three types of emissions that are covered under CBAM regulations are:

- Direct Emissions: Direct emissions include emissions generated during the production processes of CBAM goods, including from the production of heating and cooling, irrespective of the location of the production. For example, when heating and cooling occur outside the installations, the resulting emissions are counted as direct emissions.

- Indirect Emissions: Indirect emissions resulting from electricity production during the production of CBAM goods fall under the indirect emissions category.

- Embedded Emissions: Embedded emissions take into account the direct and indirect emissions of the production process and the embedded emissions of precursors.

3. CBAM’s implementation phases

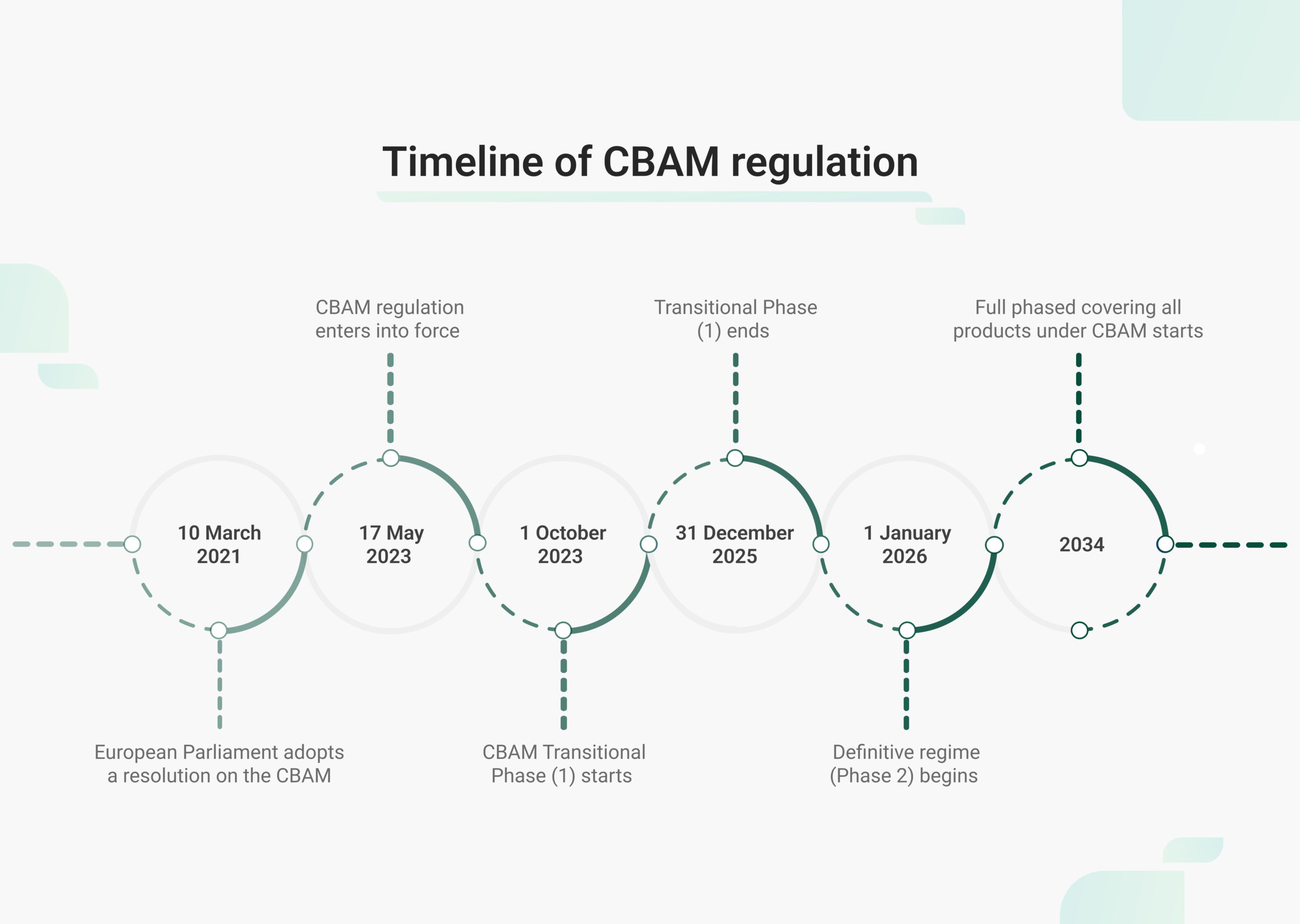

CBAM’s application is being carried out in two different phases: Transitional and Definitive Phases. The gradual roll-out is aligned with the allocation of free allowances under the EU Emissions Trading System (ETS) to support the decarbonisation of the EU industry.

Transitional Phase (Phase 1)

Phase 1 of CBAM, running from October 1, 2023, to December 31, 2025, focuses on knowledge-sharing about CBAM regulations for carbon-intensive sectors in the EU, non-EU countries, and other stakeholders. During this phase, stakeholders must report the GHG emissions embedded in their imports, including direct and indirect emissions, without needing to buy or submit certificates. This phase allows businesses time to prepare for the definitive CBAM regulations.

While the transitional phase currently includes six sectors, a review at its end will analyze adding more products under the EU ETS mechanism. The goal is to cover over 50% of carbon emissions in the EU ETS by the final CBAM stage, with all sectors included by 2034.

Definitive regime (Phase 2)

Once the transitional phase ends, the definitive regime for CBAM’s implementation will commence from January 2026. During this phase, importers will be mandated to buy and submit certificates while reporting their emissions. This phase will focus on the implementation of multiple schemes and regulations for businesses aiming to import and export Carbon-intensive products into the EU.

EU importers must register with national authorities to buy CBAM certificates. During the same phase, the cost of certificates will be calculated on the basis of the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

Moreover, the EU importers will also be required to declare the emissions embedded in their imports and then submit certificates quarterly. If the importer can prove that a Carbon price was paid during the production of the imported products, then the amount equivalent to it can be deducted.

4. Penalties for not reporting emissions

As reporting emissions is compulsory in the transitional phase, defaulters stand to face penalties if they fail to do so. If the importer does not submit quarterly emissions reports on time, the reporting declarants may face penalties (16) ranging between EUR 10 and EUR 50 per tonne for failure to report emissions.

The penalty is imposed by the National Competent Authority (NCA), which vets all submitted reports. It can take appropriate actions against organisations in issues related to false, incomplete or no CBAM reports. The NCA can also impose penalties if the “reporting declarant has not taken the necessary steps to comply with the obligation to submit a CBAM report”.

5. Challenges for CBAM reporting

The challenges related to CBAM are complex and involve the adoption of an array of systems and procedures that will ensure compliances. Here’s a look at the three major challenges to filing a CBAM report.

- Accurate Calculation: One of the biggest challenges in CBAM reporting is accurate emission calculation at the process and product level.

- Data Auditability: Generating auditable records and verifiable methodology is a challenging task that can only be accurate if digitised.

- Carbon Traceability: It is also critical to ensure timely reporting of each shipment and invoice which poses a big challenge while submitting data related to them for CBAM compliances.

The process of EU CBAM reporting and CBAM emission calculation can seem daunting for organizations undertaking it. Often, the expansive nature of carbon tracing and accounting can leave little scope or time for teams to work towards decarbonisation. However, it can be executed easily in a timely manner through automation and digitization for seamless CBAM reporting with the aide of the right CBAM reporting software for EU exporters.

A comprehensive CBAM reporting software like The Sustainability Cloud will enable data collection, embedded emission calculations, and reporting and auditing to ensure compliance with the EU’s 2023/956 Carbon Border Adjustment Mechanism (CBAM) regulation.