5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

As global trade considers embedded carbon, accurate carbon accounting is vital for compliance and continuity. Manual methods risk errors and inefficiencies, while software solutions streamline tracking, ensuring precise emissions reporting and regulatory compliance.

EU importers are experiencing the administrative and economic impacts of the Carbon Border Adjustment Mechanism. In this blog, we will do a deep-dive analysis of how CBAM will impact your business as an importer in the EU.

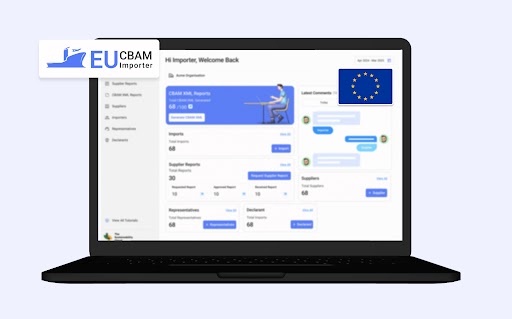

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase 1 implementation. This Phase has been particularly challenging for businesses and companies as most of them continue to adapt to CBAM. In this blog, we will discuss key learnings from CBAM implementation.

EU importers are mandated to conduct a proper emissions data audit and cross-verify the reports submitted to them by suppliers outside the EU. Here is a look at some of the best practices that must be followed while preparing for CBAM audits.

Managing emissions data is a complex challenge for EU importers, as the process involves many complexities and collaboration efforts. Here is a step-by-step guidebook for data management by importers.

The Carbon Border Adjustment Mechanism (CBAM) demands complex emissions data from non-EU exporters for compliance. To ensure accurate and error-free CBAM compliance, selecting a reliable CBAM reporting tool is essential for smooth quarterly reporting.

Scope 3 emissions represent the highest level of emissions in an organisation and plays a crucial role in climate impact mitigation and Scope 3 emissions accounting.

New CBAM reporting guidelines mandate the use of actual embedded emissions data by non-EU exporters and importers after October 31. This comes as suppliers are not allowed to use the default values for CBAM reporting from quarter 4 reporting.

End of content

End of content

Our website uses cookies which are necessary for running the website and for providing the best experience. We would also like to set optional cookies on your device. Not consenting or withdrawing consent, may adversely affect certain features and functions.

EU CBAM solution for Importers is now live! - Sign up to get 40% off 🎉