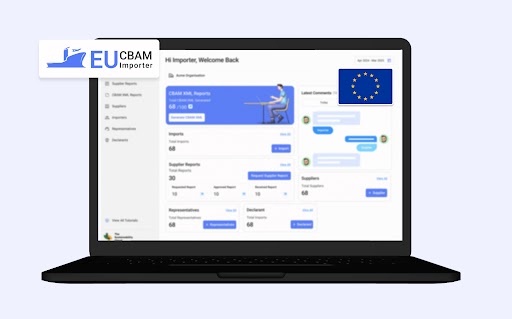

The Sustainability Cloud simplifies CBAM reporting for declarants in EU

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly report generation. The right evaluation of CBAM software depends on factors such as complexities, data collection and accuracy, among others. A look at 6 questions to consider while evaluating the CBAM reporting tool for importers.

CBAM is one of the most complex compliances, and everyone is new to this ecosystem. Nobody has any past experience in CBAM reporting. Hence, starting CBAM reporting gives you a competitive advantage and keeps you ahead of other players in the market. In this blog, we will understand 4 reasons why you should start early CBAM reporting:

EU importers have one of the most important roles in ensuring data accuracy for accurate CBAM reporting. Ensuring data accuracy by importers is a very difficult activity. However, with strategic planning and practical steps in place, emissions data and accuracy levels can be maintained.

The European Fasteners Distributors Association (EFDA) has introduced a guidebook for non-EU suppliers of fasteners subject to CBAM. The EFDA has also created the reporting template for all EU fastener importers and their members. Know how TSC NetZero helps in CBAM reporting with the EFDA template.

EU importers are mandated to conduct a proper emissions data audit and cross-verify the reports submitted to them by suppliers outside the EU. Here is a look at some of the best practices that must be followed while preparing for CBAM audits.

Managing emissions data is a complex challenge for EU importers, as the process involves many complexities and collaboration efforts. Here is a step-by-step guidebook for data management by importers.

The Carbon Border Adjustment Mechanism (CBAM) demands complex emissions data from non-EU exporters for compliance. To ensure accurate and error-free CBAM compliance, selecting a reliable CBAM reporting tool is essential for smooth quarterly reporting.

New CBAM reporting guidelines mandate the use of actual embedded emissions data by non-EU exporters and importers after October 31. This comes as suppliers are not allowed to use the default values for CBAM reporting from quarter 4 reporting.

Carbon Border Adjustment Mechanism and 12 major challenges for EU importers and EU traders. This blog identifies all significant challenges that an importer of goods entering the European Union faces during the Transitional Phase 1 and Definitive Regime with emphasis on the EU’s supply chains.

End of content

End of content

Our website uses cookies which are necessary for running the website and for providing the best experience. We would also like to set optional cookies on your device. Not consenting or withdrawing consent, may adversely affect certain features and functions.

EU CBAM solution for Importers is now live! - Sign up to get 40% off 🎉