EU importers play a critical role in implementing the Carbon Border Adjustment Mechanism (CBAM) and successful CBAM report generation. They are the first point of contact for non-EU suppliers while exporting the products into the European Union. The onus of filing a CBAM report too lies on importers, making compliance critical for them. However, the regulation is rife with challenges as the role of the importer goes beyond filing. They also have to efficiently cross-verify and manage massive amount of emissions data and details submitted by the exporters from outside the EU.

Key responsibilities of EU importers and EU traders

The importer is another name for the reporting declarant, which is an entity responsible for reporting the embedded emissions of the goods exported into the EU by the supplier. Meanwhile, an importer or a reporting declarant can be represented by three different options. These options depend on the person lodging the customs declaration. As per the Union Customs Code (UCC16), the reporting declarant can be either of these:

- The importer who lodges a customs declaration for the release of free circulation of products on its behalf.

- An individual who declares the importation of goods and holds an authorisation to lodge a customs declaration as per the UCC.

- Indirect customs representative: Under this option, the customs declaration is lodged by the indirect customs representative appointed, as per the UCC. This happens when the importer is established outside the EU.

One of the primary and common challenges faced is to ensure every tonne of imported goods is the responsibility of one reporting declarant. During the importation process involving multiple actors, it is essential for the declarant to ensure that the emissions data of the goods is neither reported twice nor omitted from reporting.

Challenges for EU importers under CBAM

The importer plays one of the most important roles in the entire CBAM compliance ecosystem. Consequently, it faces extremely complicated challenges related to data accuracy, timely reporting, cross-verification, and maintaining synergy in communication with the supplier, among other issues. Here is a look at different set of challenges faced by importers:

1.Data inaccuracies

The primary challenge is ensuring data accuracy from suppliers for their submitted reports. CBAM importers are highly dependent on their supplier for all the emissions data and have no direct control over the data-gathering process by the exporter sitting outside the European Union. This makes them highly responsible and potentially liable for any error under the CBAM regulations.

2.Bulk of emissions data

Another challenge is related to managing the massive amount of emissions data submitted by suppliers. At no level and in no way, is it easy to manage and ensure a colossal amount of data from exporters in an organised fashion without any major error. The problem worsens as nobody is so experienced in CBAM regulations.

3.Fudged emissions data by suppliers

Many exporters do not have a proper technical setup or installation to generate specific data. Consequently, importers get fudged emissions data from suppliers. This creates data credibility issues, and the importer is left in a difficult situation to ensure high-quality and extremely specific data as mandated under the CBAM.

4.Non-timely reporting

Importers will only be able to report emissions data on time if non-EU exporters submit them in a timely manner. Non-timely reporting could mean loss of business as the goods exported into the EU will not be allowed free-circulation.

5.Specific template-wise reporting

There are specific templates and formats in which the report has to be submitted to the importer by the supplier. Even the importer is required to submit its reports to the European Union in a given format and template. Their report-filing issues worsen when the supplier does not properly give them the data.

6.Penalty for inaccurate reporting

Importers can also face financial penalties for submitting inaccurate reports or fudged emissions data. Consequently, suppliers could also lose business.

7.Cross-verification of data

The importer is also responsible for conducting a proper cross-verification of emissions data. This in itself is a mammoth task as it involves a lot of technicalities, sector-specific processes, and full cooperation from the suppliers who are themselves located outside the EU. The responsibility to ensure that the correct CBAM compliance report is filed lies with the importer. The importer is also accountable for third-party verification of emissions data, which becomes mandatory from the Definitive Regime.

8.Data collection

Collecting all kinds of accurate data for the CBAM is imperative. Data collection poses multiple challenges related to the amount of CBAM goods imported, the emissions contained in those goods, and any carbon taxes paid in the country of origin. Tracing third-party operator that manufactured the products is an uphill task.

9.Use of default values

The importer must ensure that the exporters use the right default values for the respective products under the six sectors during the Transitional Phase 1 and Definitive Regime. The default values could only be used until July 31, 2024. After that, the exporters can use default values only under some circumstances.

10.Carbon tax paid

Importers also face challenges in ensuring that the details regarding the carbon tax paid by the supplier in the country of origin are accurate. Different countries will naturally have different carbon tax systems, and it is imperative for importers also to have all the information related to this.

11.Communication with multiple stakeholders

Many challenges for an importer also emerge from the difficulties in communicating with different stakeholders, including suppliers, National Competent Authorities (NCA), the European Union Commission and other options under the reporting declarants. Maintaining proper communication with all stakeholders is paramount and a very tough job for the importer.

12.Ensuring completeness of the report

The importer is mandated to ensure the completeness of the imports list and other relevant factors that must be included in the CBAM report.

Information that must be reported by importers in the CBAM report:

- The total quantity of each product in tonnes with specific details per installation producing the goods in the country of origin.

- Total embedded emissions of each type of product.

- Total indirect emissions and the amount of electricity consumed.

How is TSC NetZero helping eliminate importer’s challenges?

The primary challenge of the EU importer is to ensure the accuracy of embedded emissions data provided by the supplier stationed outside the Commission. Hence, importers must ensure the accuracy of emissions data submitted by exporters and trace back details of the manufacturing origins in non-EU countries. Additional difficulties arise in determining actual emissions, leading to credibility issues regarding data shared by operators. To successfully navigate CBAM compliance, importers must gather, manage, and process a substantial amount of emissions information from exporters outside the EU.

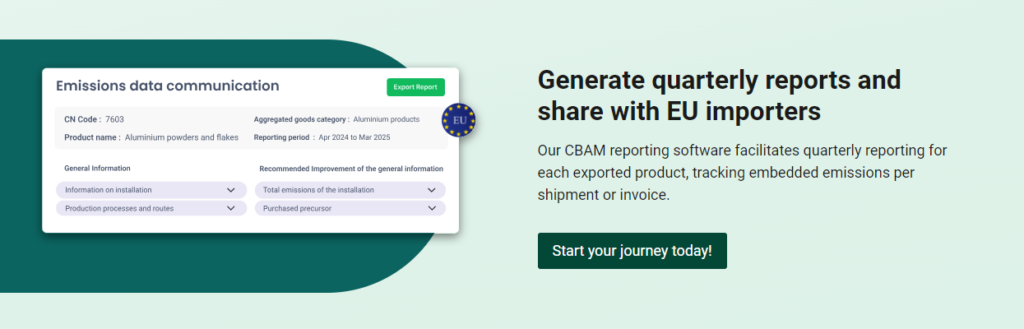

This necessitates digitising the entire data management process to achieve efficient outcomes and high-level data accuracy. Most challenges faced by importers can be mitigated by utilising comprehensive CBAM Software for Importers, such as The Sustainability Cloud, which offers an all-in-one platform to address issues related to CBAM compliance. Its comprehensive CBAM reporting tool allows enterprises data collection, embedded emission calculations, reporting and auditing to ensure compliance.