Gone are the days when only different types of economic factors and interests could change global trade and business. In today’s rapidly globalised world and climate-conscious business environment, the climate risk of doing any business is taking centre stage. Achieving NetZero targets and decarbonising the supply chains are shaping the way organisations trade, make money and minimise their climate risk.

The current spotlight is on the Carbon Border Adjustment Mechanism (CBAM) that is poised to alter global business operations and re-engineer the global economic landscape. Although the European Union has published new CBAM reporting rules, primarily for importers, under the Omnibus Package, it is still set to cast its shadow on global trade. Uncertainties of this particular carbon tax by the EU continue to persist.

In this blog, we will navigate through the trade complexities, EU CBAM global trade impacts, and how it will disrupt businesses.

What could be EU CBAM global trade economic impact?

The CBAM will impact the global economy and affect the competitiveness of many regional players. The Carbon Border Adjustment Mechanism is expected to result in an annual welfare gain of US $141 billion in developed countries, and developing countries could incur an annual welfare loss of US $106 billion, as per a comprehensive study conducted by the Task Force on Climate, Development and the International Monetary Fund (IMF). Moreover, the CBAM could cause an economic impact of $1 billion to $5 billion on countries including Ukraine, Egypt, Mozambique and Turkey.

Reports suggest that China will be forced to pay a CBAM duty of €150 per tonne on exports, India €173.8 per tonne, Russia €168.7 per tonne, Turkey €59.6 per tonne, and the USA €65.7 per tonne after the CBAM is fully implemented by 2030. Moreover, countries like India, Georgia, and Ukraine could witness cost increases greater than 10 per cent compared to EU manufacturers.

The Carbon Border Adjustment Mechanism (CBAM) is expected to result in tectonic shifts in the global economy and trade, particularly in the cement, iron and steel, aluminium, electricity, fertilisers and hydrogen sectors. The European Union Commission introduced the CBAM to facilitate cleaner industrial production and prevent carbon leakage. The entire mechanism is a replica of the European Union Emissions Trading System (EU ETS). Although CBAM is only applicable to six carbon-intensive sectors currently, it is expected to expand to more sectors in the future. it. This has already started making some strong economic ripples at the global stage.

The CBAM report will primarily impact the competitiveness of developing countries that mainly export goods made from either of the six categories under the CBAM.

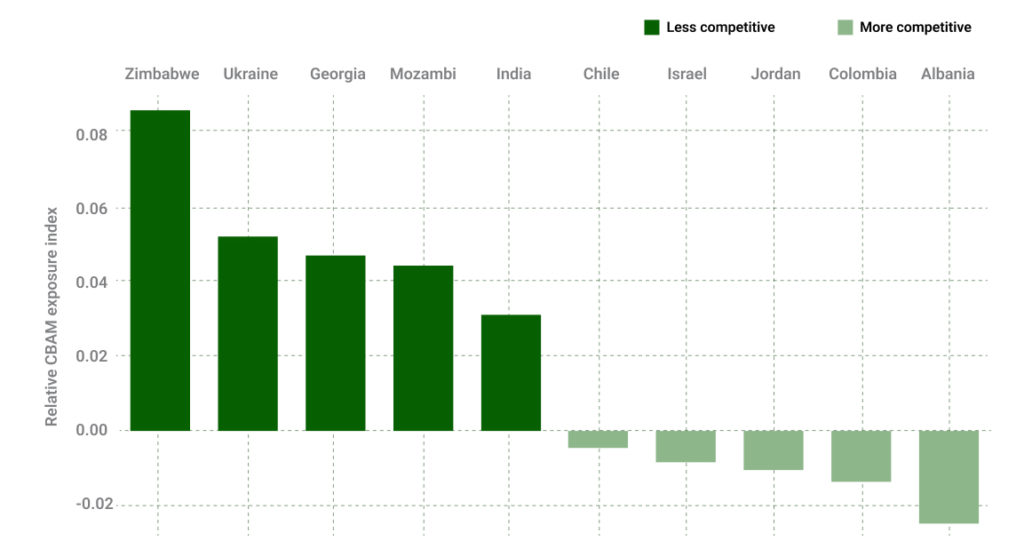

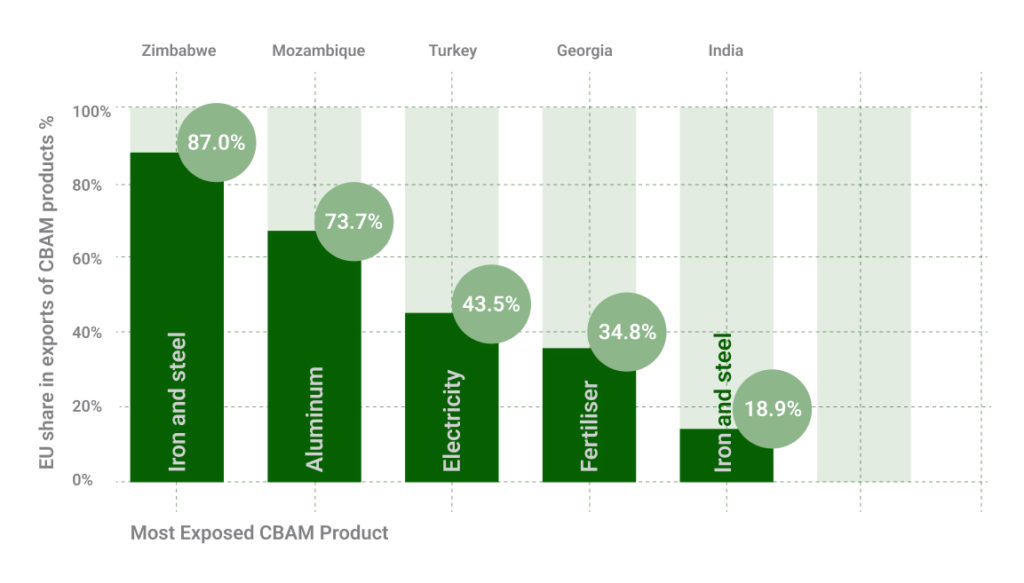

Different countries and regions across the world are massively affected by the CBAM due to high exposure to the EU market for the export of their products. For example, Zimbabwe relies on the EU to purchase 92 per cent of its iron and steel products. It is the most exposed country to CBAM in the world.

Countries most impacted by CBAM compliance reporting

CBAM’s impact on global trade will depend on factors including the volume of CBAM products to be exported to the EU, the emissions intensity, and the level of export dependence on the EU, as per the Centre for European Reform. The most significant impact of CBAM is set to be witnessed in developing countries as the EU mechanism will alter trade patterns. For instance, developing countries like India, Brazil, Vietnam, and Zimbabwe, among others, might face issues related to carbon accounting infrastructure, the right use of technology, monetary expenses and policy adoption challenges.

Although the simplification of CBAM after the Omnibus package has reduced the scope of its implementation on big EU importers that represent more than 95 per cent of total emissions, smaller declarants will face the increased amount of heat from 2027. This is because CBAM enters definitive regime in 2026 and the purchase of CBAM certificates becomes mandatory from 2027, as per the new rules under the Omnibus Package.

Global economic transitions triggered by CBAM:

- Change in trade patterns: Suppliers across the world are now under direct EU CBAM global trade pressure. Exporters with unsatisfactory carbon emissions accounting infrastructure could be redirecting their more carbon-intensive products to other destinations with no CBAM-like mechanism. For instance, a steel manufacturer in India could increase its export to any other country than the EU to avoid carbon tax and additional economic burden.

- Supply chain reshuffling: CBAM will lead to two kinds of supply chain reshuffling in the EU market and in the countries facing CBAM risk.

- Importers will go for internal suppliers: EU declarants will be going for internal suppliers, as that will mean fewer complications for the importers in terms of carbon tax.

- External supply chain reshuffling: As CBAM impacts most carbon-intensive sectors, the supply chain will witness extensive reshuffling. Many suppliers will be diverting their trade to avoid CBAM-induced carbon tax and expenditures related to CBAM compliance. For example, suppliers will divert trade to non-EU markets where carbon pricing is not so strict.

- Increased costing of products: The CBAM compliance reporting is also going to greatly influence the pricing of the product due to the carbon border tax levied on the import of the product. Moreover, suppliers will also sell the same product at a greater price to compensate for their internal costs incurred due to CBAM compliance. For instance, a steel manufacturer could sell the same product at different prices to importers and customers in any other country not part of the EU.

- Importers will prefer cleaner products to avoid carbon tax: EU declarants will most likely go for suppliers with lower carbon footprint and lesser carbon intensity to avoid paying extra for their import of the CBAM products. This will change international trade flows in favour of countries with heavy reliance on more carbon efficiency, as per a study by the Centre for European Reform. For instance, a country that supports and incentivises decarbonisation efforts will have an edge over the countries that have more carbon-intensive products and companies.

- Creation of carbon markets: Many countries have been considering the creation of their domestic carbon markets and introducing carbon pricing to cut down their CBAM exposure under the rapidly changing EU CBAM global trade. For instance, countries such as the UK, India, etc, are strongly considering their own CBAM-like structure.

- Potential trade conflicts: CBAM could also cause unprecedented trade tensions in different regions all over the world. It gives rise to retaliatory tariffs and carbon taxes from developing countries that are at high risk of CBAM. For instance, India, China and South Africa have criticised the CBAM for allegedly being a discriminatory trade barrier.

CBAM impact on the Iron and Steel industry

Global iron and steel trade could feel the most impact of CBAM due to its high carbon-intensive nature. India, which is the second-largest exporters of iron and steel in the world, will be extremely exposed to the CBAM. High carbon intensity and its high volume of exports to the European Union are additional reasons for the increasing impact of CBAM on the Iron and Steel industry. For instance, India was the 4th most exposed country to CBAM when it comes to the value of its CBAM product exports to the EU in 2023, as per the Centre for European Reform. In 2023, Iron and steel accounted for 78 per cent of India’s CBAM exports to the EU.

The CBAM-covered exports to the EU could add up to 25 per cent in additional cost or carbon tax burden once the CBAM is implemented fully, as per the Centre for Science and Environment (CSE). This is equivalent to 0.05 per cent of India’s GDP.

How to CBAM-proof your export?

Accurate data collection: Accurate embedded emissions data collection is one of the pressing challenges for suppliers across the world and EU declarants. The success of CBAM compliance reporting is directly proportional to the level of data accuracy for an organisation. Any supplier that does not have a robust data-gathering system in place is under a high CBAM-risk zone. Hence, a robust digital infrastructure is required to track, measure and reduce carbon footprint to ultimately reduce carbon tax under the CBAM.

Investment in green technologies: Both exporters and importers are new to CBAM, and they need to invest in green solutions and innovation to minimise CBAM risk. This can accelerate the CBAM compliance journey and make the process efficient and effective.

Start early to maintain competitive advantage: Early CBAM compliance gives a competitive edge over other companies in the market. Starting early CBAM reporting helps identify gaps and challenges when it comes to embedded emissions data collection. Consequently, this also means having enough time to rectify mistakes well before the competitors.

How can you eliminate your CBAM reporting challenges?

CBAM puts emphasis on accurate collection and timely reporting of embedded emissions data. Moreover, the cost of CBAM is extremely high as it directly impacts the business operations and revenue of an exporter and importer. For instance, a declarant could be forced to pay more carbon tax while submitting the final CBAM report to the EU as the supplier in India might have overestimated its carbon emissions. This means increased product pricing in the EU for imported goods, and extra expenditure for suppliers also.

More challenges crop up due to the fact that both importers and exporters are located at different places. Hence, there is a critical requirement for constant collaboration and communication between suppliers and importers. Moreover, managing such a massive amount of embedded emissions data is an uphill task if companies depend on Excel Sheets rather than a digital tool.

How TSC NetZero solves CBAM reporting challenges?

The Sustainability Cloud streamlines CBAM reporting for both exporters and importers. Designed to generate a CBAM report within minutes, the platforms ensure accurate reporting through the automated collection of data. Here’s a look at the platform’s two CBAM tools for exporters and importers.

CBAM reporting tool for suppliers

CBAM reporting tool for exporters allows automated data collection for suppliers for each input and output of every process in a CBAM product’s production route. Some important features that can minimise CBAM exposure risks for the companies and CBAM exposed countries are accurate product embedded emission calculations, generating quarterly reports, supplier portal for CBAM data collection, tracking carbon taxes paid along the supply chain, and assurance modules for third-party and first-party verification.

EU CBAM tool for importers

The primary challenge faced by the EU importers is maintaining data accuracy and a lack of adequate engagement with the suppliers. It allows EU declarants to automate end-to-end CBAM compliance reporting, decarbonise the supply chain and generate quarterly CBAM XML reports. Some critical features are generating CBAM reports and embedded emissions data from multiple suppliers across the globe at an import level or a quarterly level, audit-ready XML report generation, and an assurance module for EU-accredited verifier audits.