The world is increasingly becoming climate-conscious, and different countries across the globe have been reworking their approach to meet their NetZero targets. The European Union, which has been working to achieve its NetZero goals by 2050, has been introducing multiple climate change and sustainability policies, including the likes of the Carbon Border Adjustment Mechanism CBAM, which is the world’s first carbon tax. One of its latest regulations includes the Corporate Sustainability Reporting Directive (CSRD), which was put into force on January 05, 2023. Under this framework, large and listed companies are required to publish regular reports on the social and environmental risks they face. Moreover, companies must publish reports on how their business activities impact people and the environment.

In this blog, we will deep dive into CSRD and what it means for the businesses across the world.

What is CSRD?

The European Union’s Corporate Sustainability Reporting Directive (CSRD) was made applicable for companies for the first time in the financial year 2024 for reports to be submitted in 2025. The CSRD modernises and strengthens the existing EU rules related to social and environmental information companies must report. Under the CSRD, large and listed companies operating in the European Union must disclose information on risks and opportunities related to Environmental, Social and Governance (ESG) practices. The current CSRD has evolved from the EU’s Non-Financial Reporting Directive (NFRD). Moreover, companies need to publish their disclosures as per the CSRD’s technical rules, known as the ESRS, which stands for European Sustainability Reporting Standards.

CSRD has expanded the scope of sustainability disclosures and reporting requirements. Moreover, its reporting is done on the basis of the double materiality concept, which is at the core of CSRD.

Why was CSRD introduced?

The European Commission proposed the CSRD in April 2021 under the European Green Deal, with the objective of making Europe the world’s first climate-neutral continent by 2050. This was done after research by the European Parliament revealed that companies were consistently facing difficulties in disclosing and publishing their sustainability reports. There were several challenges identified in the data collected by the NFRD, including a lack of consistent and comparable data and metrics affecting sustainability. In order to eliminate these inconsistencies, complexities and challenges, CRSD was introduced.

The primary objective of the CSRD is to ensure companies disclose information about how their business activities impact the planet and its people. It also ensures companies gain the required information and understanding regarding the impact of sustainability goals, measures and risks on the financial health of the organisation.

How companies can comply with CSRD?

Under the CSRD directives, large companies and listed SMEs will have to report on sustainability. Moreover, some other non-EU companies are also required to report when they generate more than EUR 150 million within the European Union Market. CSRD rules are aimed at ensuring investors and all stakeholders have access to the required information needed to evaluate the impact of companies on the environment. It is also expected to inform and encourage investors to examine their financial risks and opportunities from sustainability matters.

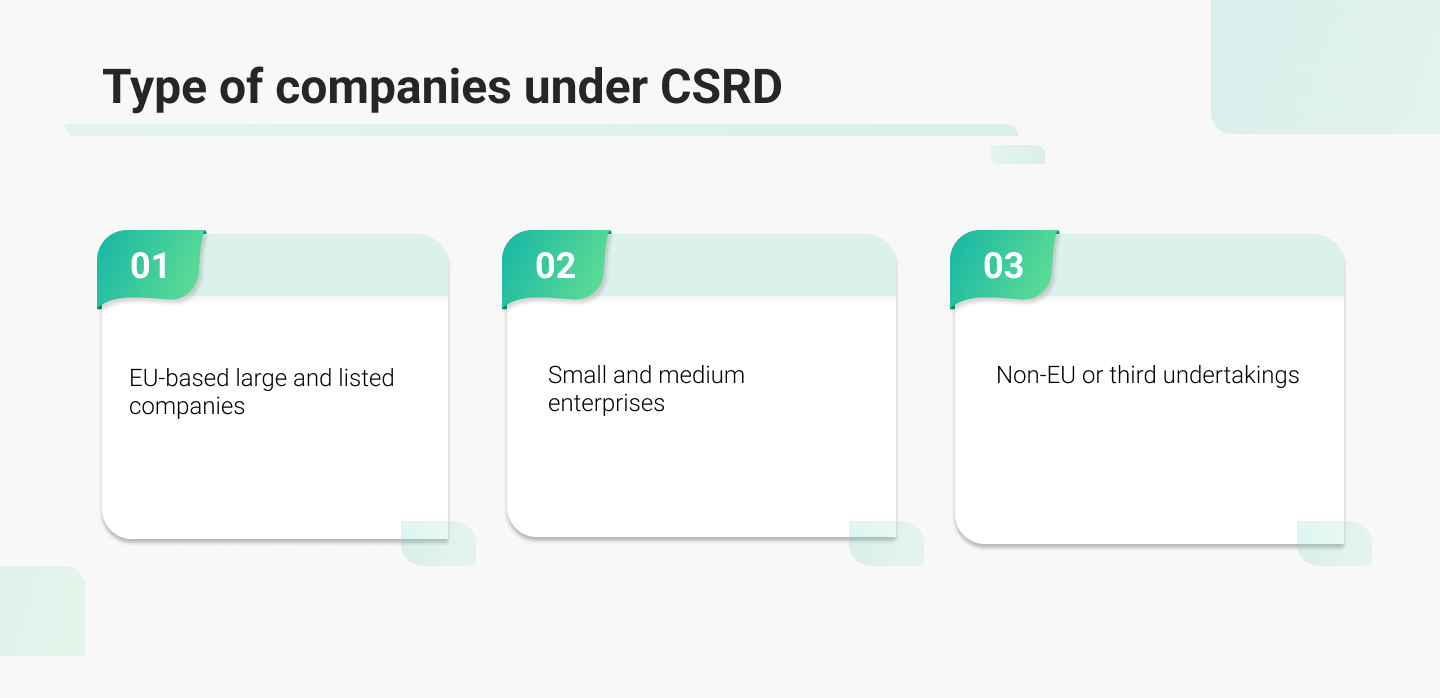

Which companies come under CSRD?

EU-based large and listed companies

Large companies that are large in size and are operational in the EU have to comply with CSRD regulations. These include any listed or non-listed large companies meeting at least two of the following requirements:

- More than 250 employees

- More than €40 million in net turnover

- More than €20 million in total assets

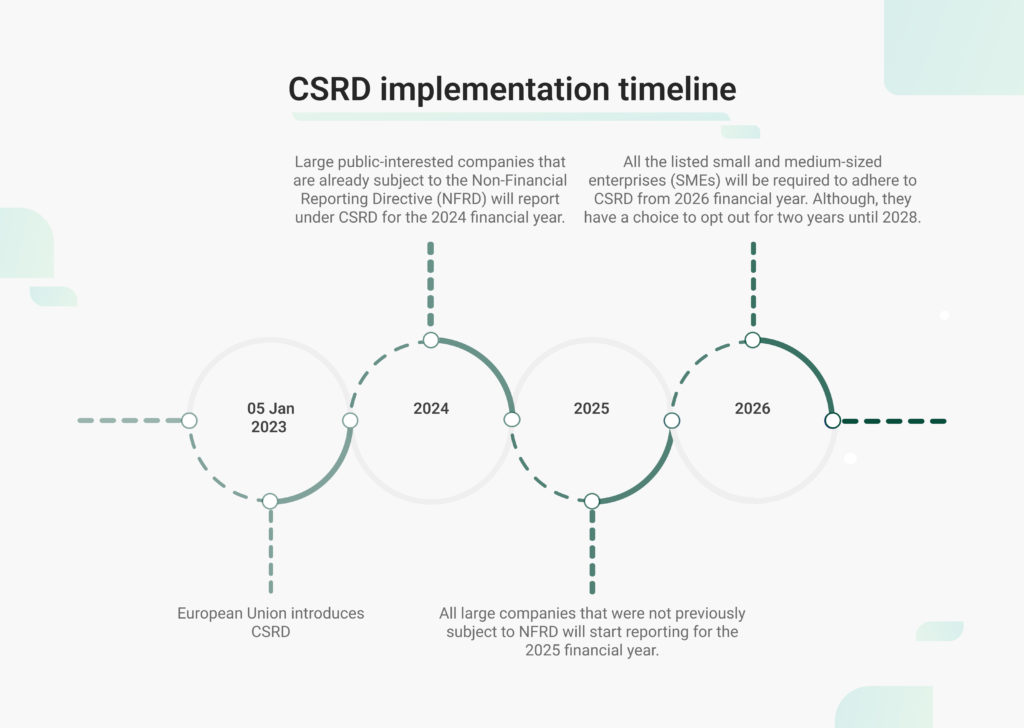

The organisations that were adhering to the NFRD regulations are required to report and publish the CSRD report in the Financial Year 2025. However, other companies that meet either of the parameters given for listed and large companies must disclose their CSRD report for the Financial Year 2025 and subsequently file the report in 2026.

Small and medium enterprises

All the listed small and medium-sized EU companies are required to comply with the CSRD. These enterprises must have an annual balance sheet of:

- More than the total of €350,000 EUR

- Net turnover of €700, 000 EUR

- At least 10 employees

Non-EU or third-country

Non-European Union parent companies also come under CSRD when they meet some parameters. Any company that operates in the European Union and meets the following requirements comes under non-EU companies of CSRD regulations:

- More than €150 million in net turnover in the EU

- Companies having subsidiary or branch in the EU

When will CSRD reporting start?

The amended CSRD rules are expected to ensure investors and other stakeholders get access to the information they need to assess the company’s impact on people and the environment. The CSRD reporting will start from 2025, as companies will have to publish the disclosures of 2024 financial year.

CSRD implementation in a phased manner

The CSRD will be implemented in a phased manner, which means that each company must implement the regulations in a different year of the timeline.

Role of EFRAG in CSRD compliances

The European Union has mandated that companies subject to the CSRD will have to report according to European Sustainability Reporting Standards (ESRS). These standards have been developed by the EFRAG, which is also empowered by the EU to regulate CSRD and its accurate compliance. The ESRS is a technical guidance document that the companies have to follow in order to ensure compliance with CSRD. It outlines the metrics organisations must report to fulfil CSRD disclosure requirements.

European Sustainability Reporting Standards (ESRS) for CSRD reporting

The primary objective of the European Sustainability Reporting Standards (ESRS) is to specify the sustainability information that an organisation must disclose as per the CSRD directive. These disclosures are about material impacts, risks and opportunities with respect to environmental, social and governance (ESG).

There are a total of 12 ESRS with details about disclosures and metrics in the sustainability matters for 3 categories with further sub-categories:

- Cross-cutting standards: These are reporting standards required for all organisations governed by the CSRD. These are general principles and disclosures applicable all the companies under CSRD ambit.

- Topical standard: Under this category of standards, Environmental, Social and Governance standards fall.

- Sector-specific standards: These standards apply to all undertakings within a sector and address impacts, risks and opportunities that are likely to be material for all company sin a sector.

Notably, cross-cutting and topical standards are applicable to all sectors.

ESRS 1 (General Requirements)

There are a number of general requirements that are common for companies under all categories. Here is a look at some significant requirements and terms under the general ERSR 1 and all other ESRS category:

Impacts: The term ‘impacts’ refer to any positive and negative sustainability-related impacts associated with the company’s business activities.

Risks and opportunities: This refers to the company’s sustainability-related financial risks and opportunities.

Double materiality: It is a concept under which, companies are required to consider two perspectives while reporting on sustainability matters. Two important perspectives that must be considered under the double materiality of CSRD are:

- Financial Materiality: Under this, enterprises focuses on how sustainability-related matters impact their financial performance and outlook. This takes into account an organisation’s financial health due to risks and opportutnities from environmental, social and governance (ESG) factors.

- Impact Materiality: An organisation must consider its impact on society and the environment. It must report under CSRD on how a company’s activities affect people, communities and ecosystems. Impact materiality takes into account environmental impacts through labour practices in its supply chain.

General disclosure areas under the CSRD

Different companies are required to provide detailed information with respect to different areas under the CSRD compliance. Here is a look at some of the critical areas:

Business model and strategy: Enterprises have to inform the concerned authority about how different sustainability matters are integrated into the organisation’s mitigation strategy, risks and opportunities.

- Sustainability targets: Organisations also have to publish disclosures of emission reduction targets and the progress made in terms of meeting those targets.

- Risk management: The disclosure report must also provide details about the identification and management of sustainability-related risks.

- Company governance: Enterprises are required to inform about their method of addressing sustainability matters.

Third-party auditing:

Under the CSRD, third-party auditing and assurance of the sustainability information and data is required. This also refers to the requirement that companies must obtain external assurance on the sustainability information they report. Here are a few factors that must be taken into consideration while ensuring third-party auditing:

- Mandatory external assurance: This means that the company gets its sustainability reports reviewed and assured by an independent third-party.

- Accredited auditors: The third-party assurance is required to be conducted by accredited auditors or institutions authorised by the government to audit the sustainability reports.

Auditors must verify all the sustainability reports’ data, completeness and accuracy. The primary aim is to enhance the transparency, comparability, and reliability of sustainability information.

Currently, there are no penalties or fines to be imposed on the companies’ operation in the EU market for non-compliance with CSRD. However, this could change soon in the near future as climate compliance becomes more rigorous across the world. Hence, preparing for CSRD reporting could keep the organisation ahead of others and give the company a competitive advantage.

Challenges in CSRD reporting

Organisations face multiple challenges related to CSRD reporting. There are a lot of different guidelines for different activities under the CSRD scope for an organisation. Here is a look at some of the major challenges faced by companies during CSRD compliance:

Data collection:

The primary challenge is collecting and reporting massive amounts of data related to sustainability-specific activities and initiatives taken and monitored by the company. Gathering, measuring and reporting a high volume of data across the entire value chain is an extremely complex exercise.

Specific guidelines:

Organisations are required to comply with many highly specific guidelines covering multiple ESG-related activities under the European Sustainability Reporting Standards (ESRS). Under the ESRS, companies have to track and report data on sustainability, environmental matters, risk management and different departments within the organisation.

Data quality:

As the CSRD mandates the collection of several kinds of data from different types of activities, maintaining high data quality is a difficult task. The CSRD clearly mandates that companies take external data quality assurances under third-party auditing rules.

Strict compliance timeline:

As per the CSRD guidelines, companies are required to adhere to strict target-setting and reporting deadlines. Organisations must provide timely information on greenhouse gas emissions reduction targets along with their timely progress on achieving the set targets. This is an extremely challenging task for any organisation as achieving these guidelines compliance targets demands a lot of internal changes and expertise in data management.

Double materiality assessment:

Under the CSRD’s core concept of double materiality, organisations have to evaluate and report on how the company’s sustainability matters affect its financial prospects and how its business activities impact the environment. This is one of the most challenging exercises, as it demands the engagement of stakeholders at multiple levels. Conducting a complete analysis and preparing the report on financial and non-financial impacts demands expertise and prior experience.

How TSC NetZero eliminates CSRD reporting challenges?

One of the biggest and primary challenges for CSRD reporting is managing massive data and maintaining its quality. This and all other challenges related to CSRD reporting can be eliminated with the help of TSC NetZero CSRD solutions. The tool offers solutions for all challenges in CSRD reporting in one place. It helps companies track and assess industry-specific data on double materiality and identify different stakeholders in data collection for highly accurate and timely data through automated data collection. It also allows organisations to match metrics to prepare reports in various formats.