CBAM rules for using the specific reporting template differ for importers and suppliers. An exporter from outside the EU is mandated to provide details of the embedded emissions, production routes and production processes. Here is a look at steps needed to submit the CBAM report.

The Carbon Border Adjustment Mechanism (CBAM) has different monitoring rules and regulations for all six products currently under its ambit. The monitoring and reporting requirements change as per varying production routes and processes for sub-categories under various products. This has mandated EU importers and non-EU exporters to follow specific formats and templates to ensure proper monitoring and reporting of emissions data.

Consequently, reporting and monitoring can be tedious and time-consuming for suppliers from outside the EU and importers in the EU. Multiple mandatory compliance requirements must be adhered to as per the given template. Moreover, accuracy of the emissions data is paramount to filling the report. The success of CBAM report submission depends on how accurately and efficiently emissions data can be gathered, compiled and organised in a given format.

But, before that, it is imperative to know where to submit the emissions report before we delve deeper into the details of the formats and templates.

Reporting emissions data on CBAM transitional registry

The Commission has developed the CBAM transitional registry to help importers perform and report as part of their CBAM obligations. Access to the registry can be requested through the National Competent Authority (NCA) of the Member State in which the importer is established. The registry link can be accessed only by importers who have been duly registered by the relevant National Competent Authorities. Importers must reach out to the NCA of its respective member state. Failure to do this will result in no access to the registry.

The EU has published the XSD file describing the full structure of the CBAM quarterly report in the CBAM Transitional Registry User Manual. It also has a sample ZIP file that can be used by the importer for the automatic submission of quarterly report data. Furthermore, the Commission has prepared a specific guidance document for declarants outlining the functioning and step-by-step use of the “request delay” options in the CBAM Transitional Registry.

ALSO READ: What has changed for CBAM default values after July 31, 2024?

CBAM reporting guidelines for quarterly emissions data

There are multiple requirements and directions that must be followed by the reporting declarants for accurate report submission. The report talks about the steps required for emission data reporting and data submission.The declarant must have some mandatory reporting details and documents available before moving ahead with the CBAM quarterly report submission. The reporting declarant must include the following details:

- Date of issuing the report

- CBAM report submission date

- Draft report ID

- Unique ID that the Declarant inserts for report’s identification

- Reporting period quarter of the year

CBAM reporting template for importers

There are multiple details that need to be mentioned by an importer in the European Union while submitting the embedded emissions report under CBAM. An importer must report only using the XML reporting template. Moreover, the importer is required to attach the link of the exporter report submitted to it while submitting the report to the EU. Here is a look at some of the primary details that an importer must be extremely attentive to:

- Report issue date: This must contain the date of the CBAM report submission.

- Draft report ID: This is the unique ID that the declarant inserts at the time of creating and saving the report. The ID is used to identify the report.

- Report ID: This is also a unique ID that is allocated by the CBAM reporting portal or system after the report is submitted.

- Reporting Period: This a CBAM local list containing details about different Quarters of the year (Quarter 1, Quarter 2, Quarter 3, Quarter 4). The importer must also have information about the year for which the report is submitted.

- Total goods imported and their total emissions: Total products and their total amount of emissions declared under the CBAM report falls under this category. Moreover, the importer must have information about the total emissions for all products declared under the CBAM report.

- Declarant’s address: Under this column of information, the importer must have all the information about the country where the declarant is established.

- Indirect customs representative: This entity is to define the information related to the indirect customs representative in the header level.

- Goods emissions per unit of product: The CO2 emissions per measurement unit of the CBAM products come under this category.

- Goods total emissions: A cumulative number of total direct and indirect emissions are required.

- Goods direct emissions: Under this category, the total emissions of direct emissions is represented.

- Goods indirect emissions: The total amount of indirect emissions.

- Installation details: Under this section, the importer must declare information about the installation ID, name and economic activities. It also includes information related to installation total emissions, direct emissions and indirect emissions.

- Justification: This segment justifies the use of alternative default value in the emission factor. This is primarily applicable in the direct embedded emissions when CBAM product is electricity.

These are just some of the primary details that need to be submitted by the importer while adhering to CBAM reporting requirements. The official document available on the EU website has more information attached in the fixed file and template format. Importer must fill up details in a sequential manner to ensure the data submission in the required format.

ALSO READ: CBAM reporting steps for EU importers trading with exporters outside EU

CBAM reporting template rules for exporters

The reporting template for suppliers is different from the one given for the importer. A non-EU exporter has to provide a detailed set of information when submitting the data to the importer. Here is a look at three primary areas of information included in the CBAM reporting template:

- Summary of installation, processes and production routes

- Greenhouse gas emissions balance and specific embedded emissions

- Detailed overview of each production process

All these three categories have an organised set of columns for the kind of information required under each one. You can access the files related to specific CBAM reporting templates and formats from the EU Website. There are different CBAM reporting templates under the name of ‘CBAM Communication template’ under the guidance section.

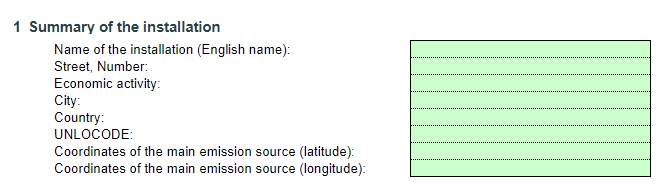

1.Summary of installation

- Under the summary of information, suppliers need to submit details, including the name of the installation, address, economic activity, reporting period start date, and reporting period end. This also contains information related to carbon price adjustment and rebate of the carbon emissions tax in the country of origin.

- This category also includes details related to aggregate goods produced, and their production processes and production routes. Second, this report also contains information related to production processes followed by the exporter along with different routes used by the supplier.

- The sub-category must also have information about the purchased precursors, aggregated goods category and production routes.

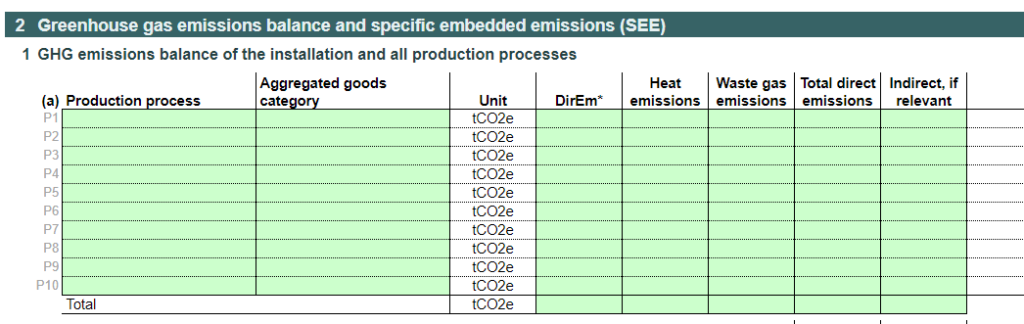

2.GHG emissions balance and specific embedded emissions

Under this, balance of GHG emissions of the installation and all production processes is contained.

- This column of information is completely focused on different types of production processes and the related aggregated goods category. This will also include information about direct emissions, heat emissions, waste gas emissions, total direct emissions, and indirect emissions.

- Under this category, specific direct emissions and indirect embedded emissions detailes are filled. Specific emissions of production processes and purchased precursors are also indlcued this category.

3.Details about each production process

As the name suggests, detailed overview of each production processes has to be provide here. Information related to aggregated goods category, default values, specific indirect and direct emissions, etc are filled here by the supplier. Everything remains the same but the production processes change.

How to ensure swift CBAM reporting for importers and exporters?

The emissions data report submitted by the supplier will only be submitted to the EU through the importer of the products. Although the EU allows for correction in incorrect submission of emissions data, both importers and suppliers must be extremely careful with regard to the data. It is imperative that the data is highly accurate, specific and timely. All reporting and technical complexities of CBAM report filing in the given template can be eliminated by TSC NetZero’s CBAM tool. It offers some defining features, including manual and automated data collection with easy ERP, SCADA, IIoT, and sub-meter integrations. Furthermore, suppliers can avail the quarterly reports generation feature and share them with EU importers. The CBAM tool facilitates quarterly reporting for each exported product, tracking embedded emissions per shipment or invoice. Moreover, the software also ensure data collection from suppliers, and streamlining data collection with reminders and workflows.