THE SUSTAINABILITY CLOUD®

CBAM reporting software for exporters outside EU

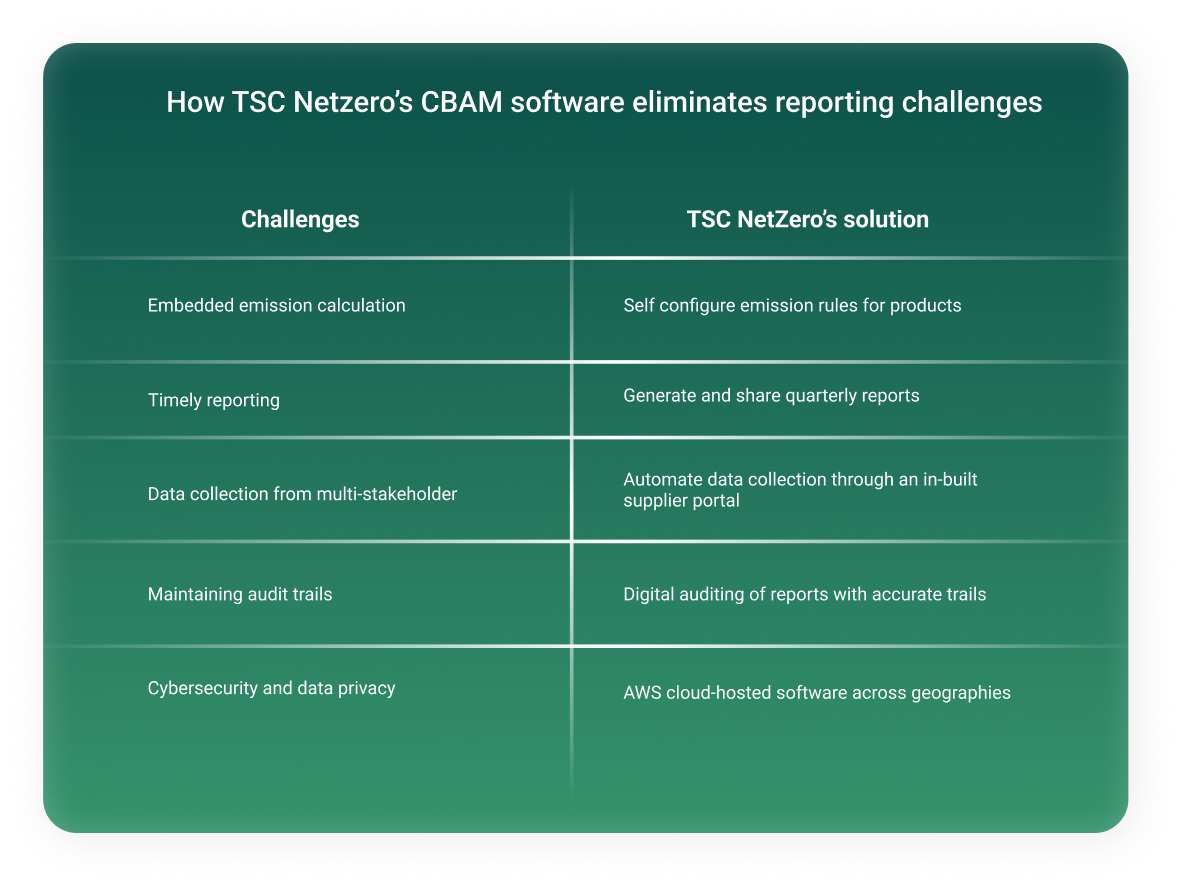

CBAM compliance software for exporters to digitise CBAM data collection, embedded emission calculations, reporting and auditing to ensure compliance with EU’s 2023/956 Carbon Border Adjustment Mechanism (CBAM) regulation.

More than 900+ enterprises globally trust us to manage their climate compliances.

Simplify CBAM reporting with The Sustainability Cloud!

Calculate your embedded emissions with our CBAM reporting software for exporters

Meet EU CBAM regulations using TSC NetZero’s advanced CBAM supplier software

Manual and automated data collection

Data has to be collected for each input and output of every process in a CBAM product’s production route.

Accurate product embedded

emission calculations

CBAM necessitates calculating embedded emissions at product and process levels, posing greater complexity than Scope 1, 2, and 3 accounting.

Generate quarterly reports and share with EU importers

CBAM requires quarterly reporting on every shipment or invoice exported to the EU. This can be a daunting task.

Supplier portal for CBAM data collection

CBAM requires you to collect essential supplier data, including embedded emissions and production routes for all precursors.

Assurance modules for third-party and first-party verification

CBAM demands records to be highly auditable. It requires traceability in calculation, monitoring methodologies, data quality, emission source streams, and more.

Track carbon taxes paid along your supply chain

CBAM requires you to report carbon taxes paid on imports from countries with carbon tax compliance.

Manual and automated data collection

TSC Netzero enables automated data collection with easy ERP, SCADA, IIoT, and sub-meter integrations. Monitor emissions in real-time directly via CEMS.

Accurate product embedded emission calculations

Our CBAM calculation engine makes it easy to set emission calculation and attribution rules for each product and process, resulting in precise and accurate calculations.

Generate quarterly reports and share with EU importers

Our CBAM reporting software facilitates quarterly reporting for each exported product, tracking embedded emissions per shipment or invoice.

Supplier portal for CBAM data collection

Collect primary data from suppliers via our supplier portal, tracking progress and streamlining data collection with reminders and workflows.

Assurance modules for third-party and first-party verification

Access digital MMD templates for every CBAM product. Digitize third-party audits by inviting EU-accredited auditors via TSC Netzero’s assurance modules.

Track carbon taxes paid along your supply chain

Keep track of carbon taxes paid by you or your supplier down your supply chain. Maintain digital audit trails for each record.

Calculate your embedded emissions with our CBAM supplier software