EU importers and suppliers have been adjusting to the European Union’s Carbon Border Adjustment Mechanism (CBAM), which has been in force since October 1, 2023. Both suppliers and EU importers have been grappling with the crucial task of data collection for import reports. The shift in emissions reporting rules for CBAM products after the third quarterly report submission is a significant development. The EU CBAM guidelines now mandate the use of actual emissions for reporting, which is a shift from allowing suppliers to use default values, underscoring the importance of this change.

In this blog, we will dissect what are the new rules for reporting that mandate actual emissions to be used from October 31, 2024 under the transitional phase 1.

What are actual emissions?

Actual emissions are the emissions calculated based on primary data from the production processes of goods and the production of electricity consumed during these processes. This definition is in line with the methods outlined in Annex IV [to the Implementing Regulation].

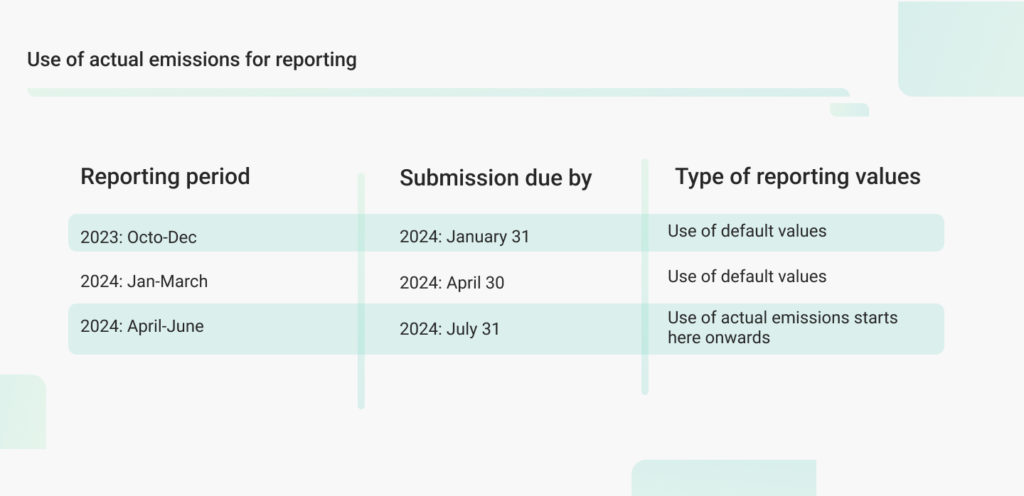

As per the CBAM reporting guidelines, actual emissions must be used from October 31, 2024, during the transition period. These rules apply after the completion of three quarterly reportings by non-EU exporters. This marks a new shift in CBAM reporting as until July 31, 2024, the exporters and importers could use default values for the release of free circulation of products into the Europen Union market. The use of default values for the purpose of reporting during the transition period was allowed for the first three reporting periods without quantitative limits.

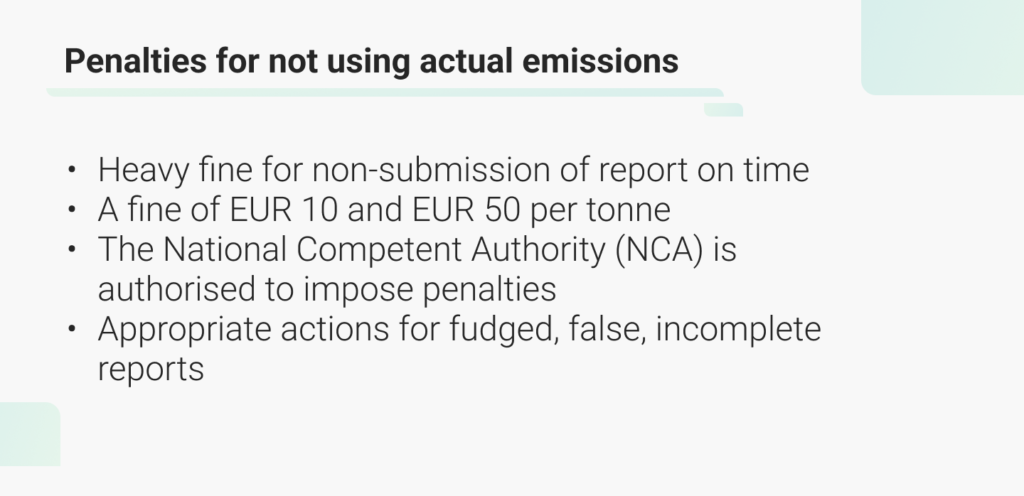

Fines for not using actual emission

The European Union CBAM guidelines will impose substantial fines on importers and non-EU exporters who fail to use actual emissions for quarterly reports from October 31 onwards. As reporting emissions is mandatory during the transitional phase, defaulters risk facing penalties. For instance, if an importer fails to submit quarterly emissions reports on time, the reporting declarants may be fined between EUR 10 and EUR 50 per tonne for non-compliance.

These penalties will be imposed by the National Competent Authority (NCA), which vets all reports.It can take appropriate actions against organisations in issues related to false, incomplete or no CBAM reports. The NCA can also impose penalties if the “reporting declarant has not taken the necessary steps to comply with the obligation to submit a CBAM report”.

4 challenges in actual emissions reporting

Production details:

Collecting actual embedded emissions is a complex affair as it involves defining an exporter’s production processes, production routes, and plant installation details.

Supply chain data complexities:

Organisations also depend on third-party suppliers to gather and collect emissions data. However, suppliers need to prepare to ensure better monitoring and collection of the emissions data. The complexity of supply chain data management is very high as products have multiple stages of production, from raw materials to the final product.

Inadequate technical set-up:

Moreover, insufficient infrastructure to measure and manage emissions accurately makes it extremely difficult to report actual emissions.

Data accuracy:

Inaccurate reporting of actual emissions data due to inadequate technical expertise is a challenge, as different countries have different environmental regulations. Verifying the accurate emissions data is a logistically and financially challenging task.

How can TSC NetZero help gather and report actual emissions?

Digitising emissions data is the most effective approach due to the time-consuming and complex nature of the process. Accurate data collection and management are essential for verification and auditing. The most effective way to implement CBAM is through digitising emissions data as the process is time-consuming and complex. Emissions data must be collected in a specific format, and managing and maintaining this large-scale data is tedious. However, ensuring the accuracy of emissions data on such a large scale can be challenging. Here, product solutions like TSC NetZero’s CBAM reporting software can resolve all challenges related to becoming CBAM-ready and digitising the entire process with ease and high efficiency. It offers hassle-free solutions to all challenges on a single platform.