The increasing impact of climate change has put the European Union (EU) at the forefront of global efforts to mitigate environmental degradation. Consequentially, the EU has intensified its regulations for carbon emissions and the carbon footprints of products entering its market. According to European Union Commission data, the EU is the biggest export market for around 80 countries. With a market of this scale, controlling the carbon footprint of the products entering its markets is essential for fair pricing and climate change mitigation. This has led to CBAM reporting to regulate the trade of carbon-intensive products for non-EU countries.

Non-EU companies now must comply with the regulations to trade within the European Union. Failure to comply can prevent organizations from entering the EU market or exporting carbon-intensive goods. The challenge for operators outside the EU lies in their lack of experience and understanding of CBAM, hampering swift implementation. However, this challenge can be mitigated by digitizing data collection processes, which significantly assist in meeting CBAM requirements. High data accuracy is essential for certification, making proactive engagement crucial for compliance.

In this blog, we will dissect the regulations for non-EU countries in detail, and how they can avoid financial setbacks due to CBAM.

Who are non-EU operators?

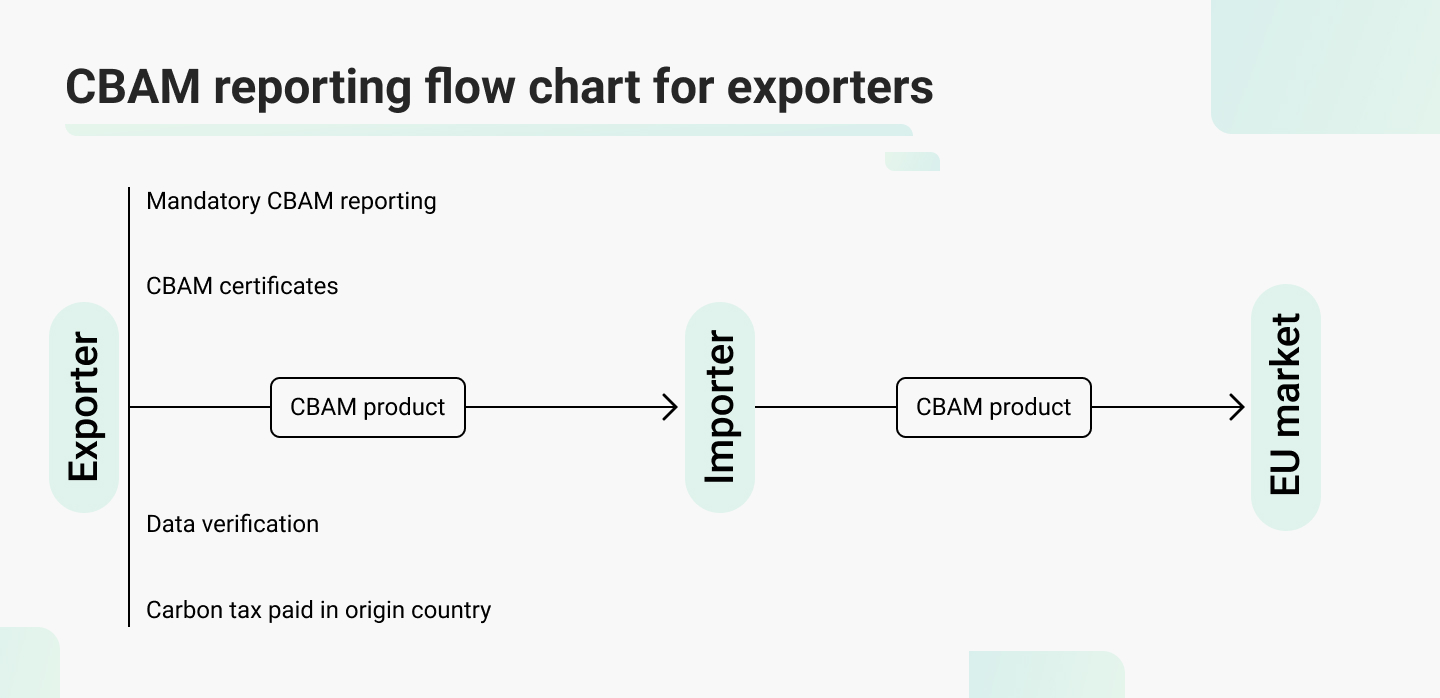

Non-EU operators are exporters of carbon-intensive products from outside the EU. They are responsible for providing reports on direct and indirect emissions in the production of CBAM products exported to the EU.

Any exporter outside the EU whose CBAM products are exported or imported into the EU have to submit information about ‘embedded emissions’ if the importer asks.

The regulatory framework also applies to exporters if their products are purchased by clients who themselves manufacture CBAM goods. The same regulations will apply if a CBAM-compliant product is used to make other CBAM-compliant products.

A few countries are exempted from the CBAM regulation such as Iceland, Liechtenstein, and Norway. Switzerland is exempt from CBAM because it is connected to the EU’s carbon market. The EU and Switzerland have an agreement that links their emissions trading systems, ensuring they have a coordinated approach to carbon pricing.

Identifying CBAM goods

Every exporter must know the Combined Nomenclature (CN) code, a classification system used by the EU for customs declarations, to determine if their products fall under the regulations. Non-EU businesses should compare their products with the CN codes in the guidance documents. Currently, CBAM regulations apply to six sectors: cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen, but are expected to expand to other sectors in the future.

Set up needed to get started on CBAM reporting

- An automated system to ensure accurate data collection across the production process

- Record embedded emissions of the product

- Initiate the creation of the Monitoring Methodology Document (MMD)

- Begin calculation of different CN code products

- Generate and report data

Key points to track before you start CBAM reporting

Once the reporting setup is complete, enterprises need to track and create specific data for the report. These guidelines ensure CBAM compliance and align exporters’ carbon emissions reporting and reduction efforts with the EU’s environmental standards.

- Registration: Exporters outside the European Union must register with the National Competent Authority (NCA) in the EU member states where the importer is located. Registration must be made through the importer. Detailed information about the company and data about the CBAM goods to be exported to the EU need to be submitted in this process.

- Define production processes: All operators (exporters) must define their production processes (system boundaries that are needed to attribute emissions to specific goods produced) and production routes. There are different production processes and production routes.

- Define reporting period: Non-EU operators must define their reporting period for carbon emissions, which determines the reference period for embedded emissions. Exporters and importers have different periods, with the default being twelve months to collect data reflecting annual operations.

- Carbon emission report: Non-EU businesses must submit quarterly reports detailing indirect, direct, and embedded carbon emissions, including emissions from precursors used in producing CBAM products.

- Carbon tariff: The operators must inform about the carbon tax paid in the country of origin to avoid being levied double tax. If a certain amount of carbon tax is already paid by the operators in the country of origin, then the carbon prices to be paid by the importers/exporters for the particular product can be adjusted to ensure price equivalence.

CBAM regulation requirements vary with its implementation stages; here are the different requirements during each phase.

CBAM compliances during Transitional Phase 1 (1 October 2023 to 31 December 2025)

- Mandatory submission of quarterly report of emissions

- Voluntary verification/auditing for submitted emission data

- Financial penalty applicable for non-submission of reports per se

- Non-EU operators must learn more about CBAM

- Preparations aimed at making companies CBAM-ready

Multiple CBAM compliances will become mandatory during the Definitive Regime for non-EU operators. Towards the end of Transitional Phase 1, a complete review of the regulation will be done to gradually cover more products under the EU ETS until the list is exhausted. In the final stages of the full roll-out, more than 50 per cent of the carbon emissions in the EU Emissions Trading System (EU ETS) sectors will be covered.

The European Commission plans to cover all products in the EU ETS list, so exporters outside Europe must be proactive about CBAM if their products fall under this category.

CBAM compliances during Definitive Regime (Phase 2) (starting 1 January 2026)

- Mandatory reporting of accurate emission reports

- Data accuracy verification/auditing required for submitted emissions

- Penalties for reporting false and fudged emissions data

- Non-EU operators must be ready with technical setups to comply with CBAM

- CBAM certificates are mandatory from Phase 2

- Non-cooperation in data verification processes will invite penalties

- Non-surrender of carbon tax certificates (in case of country-specific carbon tax) will invite a penalty

Non-EU operators have the second-most responsible role in the functioning of CBAM. The people operating the installation outside the EU have direct access to all the details and information about their installations’ emissions.

What businesses will lose due to non-compliance to CBAM?

It is essential for enterprises to manage carbon emissions and reduce them consistently, systematically, and scientifically. Failing to do so can cause them to fall behind in competition. As regulations become more stringent, players in the European Union market may not engage in any trade with firms (non-EU operators/businesses) that are not able to share accurate data on carbon emissions. Additionally, enterprises may be forced to pay an exorbitant carbon price if they don’t take appropriate and timely actions to reduce emissions as per CBAM guidelines and regulations.

Overcoming CBAM’s reporting challenges

Most CBAM regulations become compulsory in the Definitive Phase; thus, understanding the compliance and using Transitional Phase 1 as a preparatory period is crucial. During this phase, digitizing emissions data is the most effective approach due to the time-consuming and complex nature of the process. Accurate data collection and management are essential for verification and auditing.

The most effective way to implement CBAM is through digitising emissions data as the process is time-consuming and complex. Emissions data must be collected in a specific format, and managing and maintaining this large-scale data is tedious.

However, ensuring the accuracy of emissions data on such a large scale can be challenging. Here, product solutions like TSC NetZero’s CBAM reporting software can resolve all challenges related to becoming CBAM-ready and digitising the entire process with ease and high efficiency. It offers hassle-free solutions to all challenges on a single platform.