Iron and steel form a significant part of the Carbon Border Adjustment Mechanism (CBAM) goods category that is exported into the EU from different countries worldwide. Zimbabwe exports over 91% of iron and steel to EU, followed by Norway at 73%, and the United Kingdom at 66% among other countries, as per the World Bank data.

The large volume of exporting naturally calls for regulations that ensure pay parity and keep a check on carbon-intensive products entering the EU. CBAM, which is currently in a transition phase, was introduced with the sole purpose of eliminating pay disparities, carbon-leakage and ensuring a greener economy to achieve NetZero.

In this blog, we will take a detailed look at the iron and steel industry in the context of CBAM implementation and its sector-specific compliances for EU importers and non-EU exporters.

CBAM for iron and steel sector products

The quantity of iron and steel sector goods imported into the EU should be expressed in metric tonnes. For reporting, an exporter should record the quantity of CBAM goods produced by the installation in each production process. Moreover, the iron and steel sector is required to account for direct and indirect emissions in the transitional period. Non-EU exporters must report emissions data in metric tonnes of CO2 equivalent (t CO2e) emissions per tonne of output.

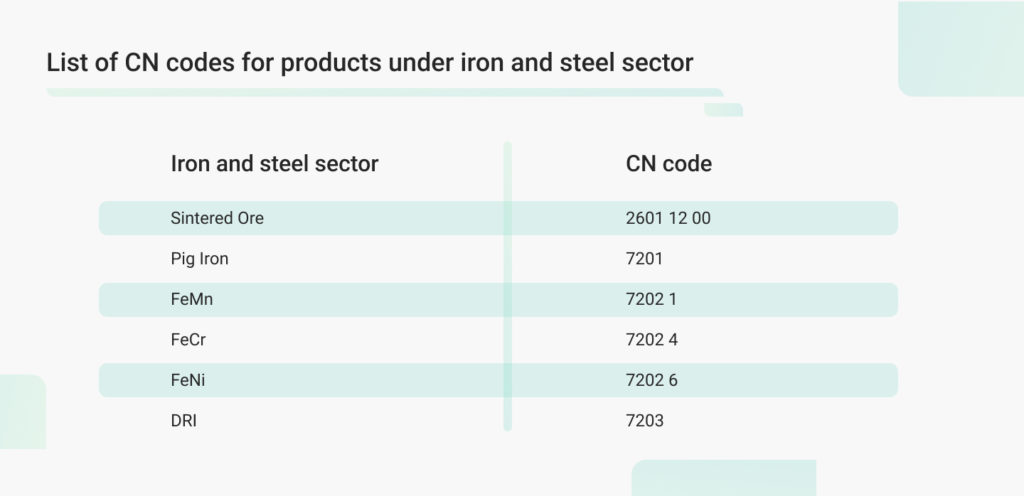

Different products under the CBAM have different Combined Nomenclature (CN), which is a classification system defining the essential characteristics of goods. It is used to identify different products under iron and steel sector goods. The CN ‘product specification’ classification system comprises two parts, firstly a numerical 4, 6 or 8-digit numbering system, reflecting different levels of product disaggregation, and secondly a short text description of each product category giving its essential characteristics. The first 6 digits are identical to the Harmonised System (HS) classification used in international trade and the remaining 2 digits are EU-specific additions.

Sector-specific requirements for CBAM reporting

Reporting requirements for the iron and steel sector also are very specific, and any exporter as well as importer, has to be very particular about reporting the emissions in the given template. Here is a look at the specific parameters non-EU exporters need to report:

- Direct carbon dioxide emissions from the fuel combustion process from stationary units.

- Direct carbon dioxide emissions resulting from the reduction of iron and steel by reducing agents such as coke or natural gas

- Direct carbon dioxide emissions from the production of measurable heating and cooling that is consumed within the system boundaries of the production process

- Direct carbon dioxide emissions from emissions’ control methods and activities

There are other details required for emissions data reporting for iron and steel. The reporting metrics for iron and steel is (per) tonne of good and the greenhouse gas to be covered is only CO2. Moreover, emissions coverage during the transition period is direct and indirect. During the definitive period, only direct emissions will be covered, and this is subject to review.

The determination of direct embedded emissions is required to be determined on the basis of actual emissions. Notably, the default values can be used for up to 100% of the specific direct embedded emissions for imports until 31 July 2024. It is only applicable for up to 20% of the total specific embedded emissions of complex goods for imports until 31 December 2025.

Specific requirements for production processes and routes

There are various production processes and routes for products in the iron and steel sector. The purpose of allowing different reporting methods is to ensure accurate emissions data is collected and reported. Take a look at the diverse production processes:

Sintered ore production process:

Sintered ore is a material used in the steelmaking process. It is produced by agglomerating fine iron ore particles with other materials, such as fluxes (limestone, dolomite) and solid fuels (coke).

Indirect emissions resulting from electricity consumed by the production process should be monitored under this process. No relevant precursors are used for this specific production process. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring for the sintered ore production route.

Ferro-alloy FeMn, FeCr, and FeNi production processes:

Ferro-alloy FeMn, or ferromanganese, is an alloy composed primarily of iron (Fe) and manganese (Mn). It is produced through a smelting process in a blast furnace or an electric arc furnace, using manganese ore, iron ore, and carbon (usually in the form of coke).

A relevant precursor is monitored to see if it is used in the process. Ideally, sintered ore is the relevant precursor here. Moreover, indirect emissions that result from electricity consumed by the production process should also be monitored. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring.

Pig iron – Blast furnace production route:

Pig iron is a basic form of iron that is produced in a blast furnace. It is an intermediate product in the steelmaking process, used as a raw material for producing wrought iron, steel, and other iron-based products.

Relevant precursors are monitored if they are used in the production process. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring. Additionally, indirect emissions that result from electricity consumed by the production process should also be monitored.

Pig iron – Smelting reduction production route:

Pig iron is a basic form of iron produced in a blast furnace, serving as an intermediate product in the steelmaking process. Relevant precursors to be monitored for this are sintered ore, pig iron or DRI from other installations or production processes if used. Indirect emissions that result from electricity consumed by the production process should also be monitored. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions to be monitored.

Direct Reduced Iron (DRI) production process:

Relevant precursors that should be monitored are sintered ore; hydrogen, pig iron or DRI from other installations or production processes. Indirect emissions that result from electricity consumed by the production process should also be monitored. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring for the DRI production route.

Crude steel – Basic oxygen steelmaking production route:

Crude steel is the initial product of the steelmaking process. It is an unrefined form of steel that serves as the raw material for producing finished steel products.

The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring for the Crude steel – basic oxygen production route. Relevant precursors include pig iron, DRI, ferro-alloys FeMn, FeCr, FeNi, and crude steel. Indirect emissions from electricity consumed by the production process should also be monitored.

Crude steel – EAF steelmaking production route:

Relevant precursors that should be monitored are pig iron, DRI, ferro-alloys FeMn, FeCr, FeNi, and crude steel from other installations or production processes, if used. Indirect emissions from electricity consumed by the production process must also be monitored. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring for the Crude steel – EAF production route.

Iron or steel products production process:

Relevant precursors to be monitored are crude steel, pig iron, DRI, ferro-alloys FeMn, FeCr, FeNi, and other iron or steel products. Indirect emissions resulting from electricity consumed by the production process should also be monitored. The Implementing Regulation (section 3 Annex II) defines the system boundaries for direct emissions monitoring for the iron or steel products production route.

Different production processes and technology used for products under iron and steel are very complicated. The operator must be very particular about them to ensure a watertight outcome in strict adherence to CBAM compliance.

How to ensure accurate CBAM compliance for iron and steel?

CBAM reporting for non-EU exporters and EU importers involved in iron and steel products can be a highly daunting, taxing and detail-oriented task. The entire reporting framework and compliance process are very technical in nature due to specific requirements of emissions data management, measurement, and reporting only in the given template. Additionally, successful CBAM compliance for varying sub-categories and particular activities under iron and steel depends on a highly accurate rate of data collection and processing. However, all these challenges can be eliminated by the CBAM reporting software offered by The Sustainability Cloud. It easily resolves challenges such as self-configuring emission rules for different products, generating quarterly reports, and automating data collection through an in-built supplier portal for multiple stakeholders. The Sustainability Cloud’s CBAM reporting platform helps identify and create a CBAM-compliant product list. Its end-to-end platform resolves challenges related to calculation methods for different inputs in any production process and route.