The cement industry is one of the major sectors of the CBAM regulations, and its rules apply differently to it. The CBAM framework, introduced to prevent carbon leakage and control carbon emissions in Europe, includes sector-specific regulations. The list of rules and compliances also varies during the transition period and definitive phase. Europe’s cement industry valuation is expected to increase from US$19,026.5 million in 2023 to US$31,742.5 million in 2033. According to a report by UK-based PRNewswire, Europe’s demand for cement is anticipated to grow at 5.3 per cent from 2023 to 2033. Given the rapidly growing cement industry market, exporters outside the EU must be ready to stay ahead by meeting CBAM compliances.

Traders engaged in export businesses with Europe are under mounting pressure to continue to do business in the EU after the start of the transitional period under CBAM regulations. Different sectors such as cement, aluminium, steel, fertiliser, hydrogen and steel must undertake various steps to ensure a successful CBAM compliance journey, which is a mechanism to address carbon leakage by the import and export of carbon-intensive products into the EU.

In this blog, we will understand more about CBAM regulations and compliances in the cement sector.

Cement: Steps for CBAM reporting

In the transitional period, exporters and importers in the cement sector must account for both direct and indirect emissions. The emissions must also be reported in metric tonnes of CO2 equivalent (tCO2e) emissions per tonne of goods output. Here’s a look at the preliminary steps that need to be taken:

- Step 1: Define the scope of goods concerned

- Step 2: Determine the reporting period to use

- Step 3: Identify all the parameters needed to report

- Step 4: Collect data on carbon price due in the jurisdiction, if any

Categories of cement goods covered in CBAM

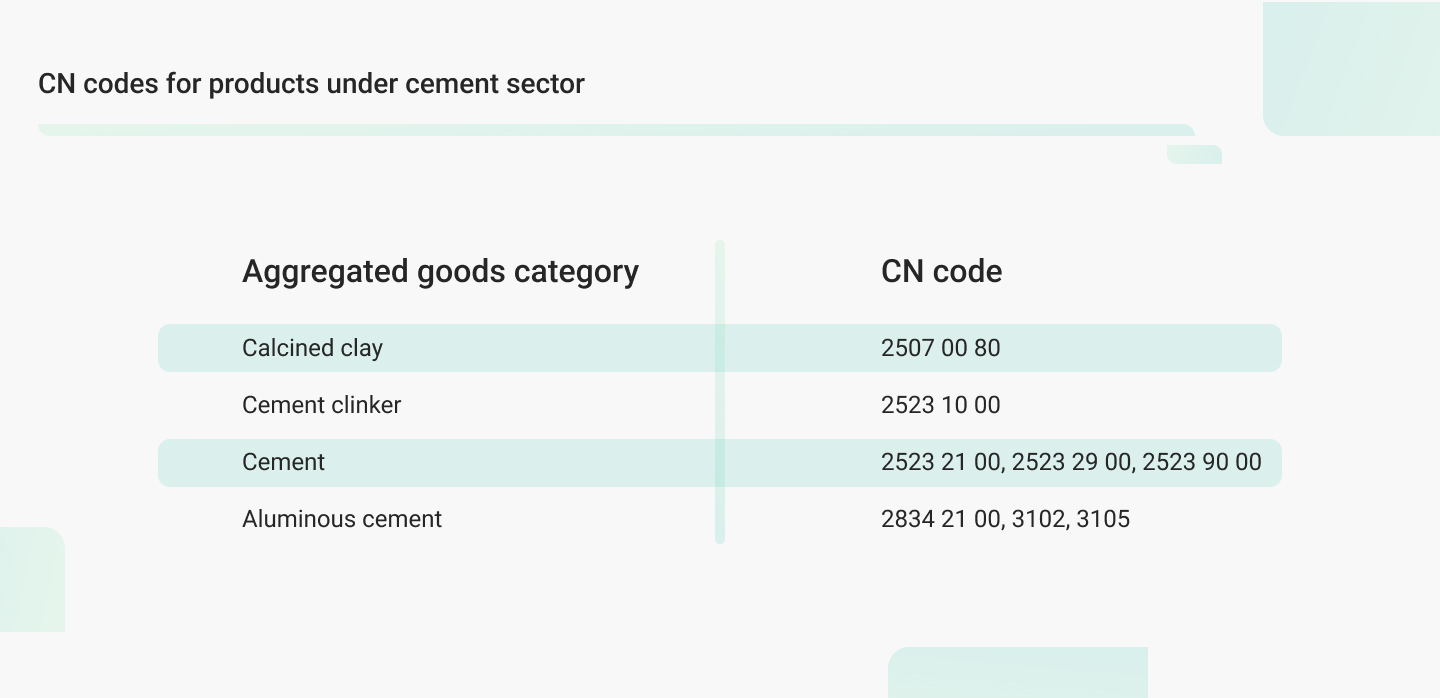

CBAM identifies different goods in the cement sector through CN codes. It classifies the goods into sub-categories like white Portland, other Portland cement, and other hydraulic cement. For each category, emission data on precursors of different cement products have to be shared with the importer. Products that have the properties of cement clinker, calcined clay, and others must also submit embedded emissions of precursors.

The goods categorised in CBAM regulations are as follows:

These categories include finished cement products and precursor goods such as cement clinker and calcined clay used in cement production. Since the production processes and routes for different cement items vary, not all cement goods must submit emission details about the precursors.

Declarations required under different cement goods in CBAM reporting

There are various methods of production processes and production routes for diverse cement products that are covered under CBAM during the transitional and definitive period. It is imperative to note that the system boundaries for precursors and cement goods are distinct but can sometimes be combined. This means that all processes directly or indirectly related to the production, including input and output activities, are included in the emissions reporting.

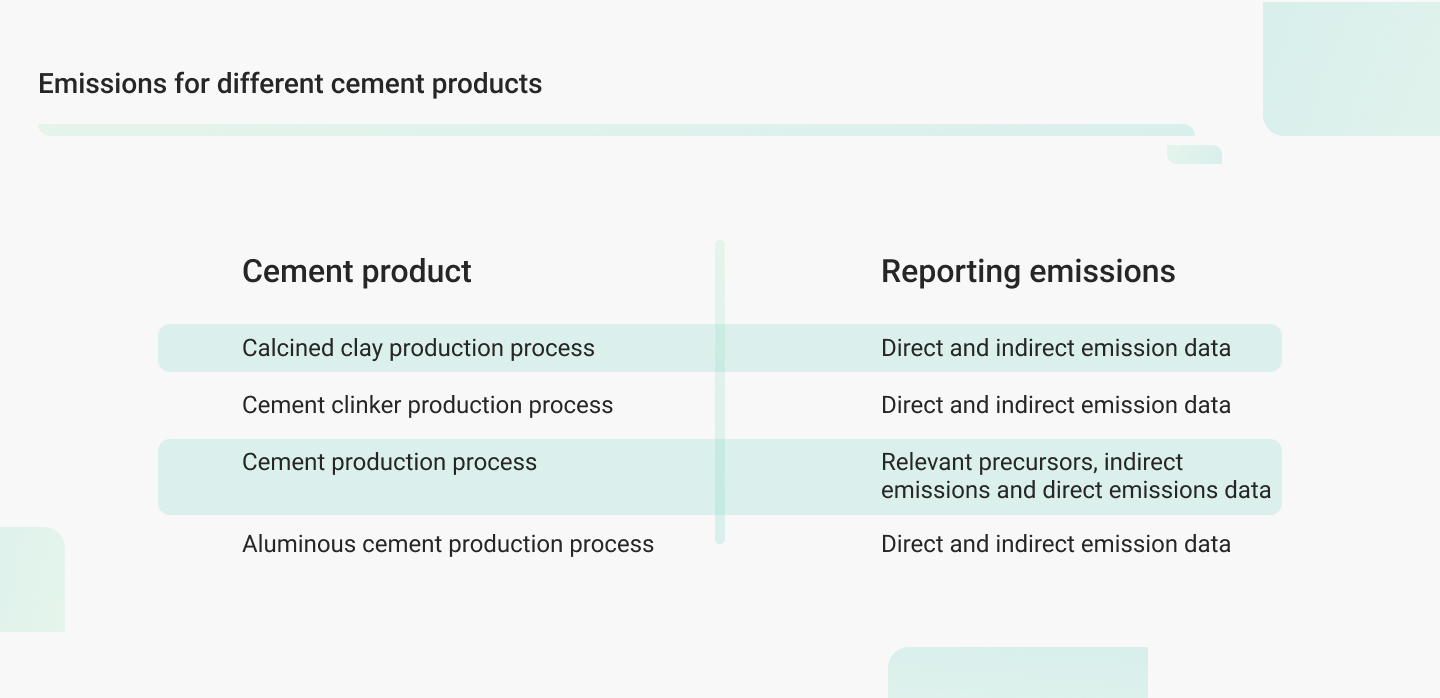

Different types of emission reporting for different cement products:

Different production processes and routes for cement products

Calcined clay production process

For this particular type of production process, the embedded emissions of precursors need not be submitted. Only direct and indirect emissions data must be collected and shared with the importer.

The report must include details about raw material preparation, mixing, drying, calcining, flue gas cleaning, and CO2 emissions from the combustion of fuels and raw materials, where relevant.

Cement clinker production process

Cement clinker is produced in clinker plants (kilns). Its production involves the thermal decomposition of calcium carbonate to form calcium oxide. After this, a clinkering process is conducted in which the calcium oxide reacts at high temperatures with silica, alumina, and ferrous oxide to form a clinker.

The exporter must submit direct and indirect emissions reports for this type of production processes. There is no need for precursors’ reports to be submitted. However, the exporter must maintain a record and monitor indirect emissions from electricity consumed during production.

Cement production process

Cement is classified as complex goods since it is produced from relevant precursors such as cement clinker and calcined clay. The exporter has to submit the details about relevant precursors, indirect emissions and direct emissions that result from the production process.

Aluminous cement production process

Aluminous cement is classified as a simple goods because it is produced directly from aluminous clinker through continuous production. Indirect and direct emissions should be monitored during production, which should be submitted to the importer for the CBAM compliance journey. Emission reports and data related to the precursors are not imperative to be submitted for this production process.

Cement-specific reporting requirements under CBAM

Under the cement sector, there are multiple monitoring and emissions data reporting requirements depending on the activity. Here is a look at what and how different cement-related activities should be monitored:

- Carbon dioxide emissions (direct) from the fuel combustion process: Emissions from stationary plants should be monitored. This does not include any mobile plant-like vehicles.

- Carbon dioxide emissions from processing activities: Carbon dioxide direct emissions from the process resulting from the thermal decomposition of carbonate-containing raw materials (such as limestone, dolomite, etc.) are required. Direct emissions from non-carbonate carbon content in raw materials are also required.

- Direct emissions from heating and cooling process: Exporters must provide Carbon dioxide direct emissions data from the production of measurable heating and cooling consumed within the system boundaries of the production process.

- Carbon emissions from emission control system: Exporters of cement products from outside the EU must also submit details of carbon dioxide emissions resulting from emission control methods.

Notably, indirect emissions from electricity consumed during the production process must be reported separately. There are additional monitoring and reporting parameters for exporters of products under CBAM. To complete the emissions reporting and communication with the importer, cement exporter must also inform about the clinker content of the cement (Mass ratio of tonnes cement clinker consumed per produced tonne of cement (clinker to cement ratio or CCR).

Key focus areas for exporters of cement products

There are some general parameters that apply to the cement sector for an exporter to be able to create an error-free CBAM compliance journey. Here is a list of some general things to be done by any cement exporter in the EU:

- Registration: Exporters must register their installations with the appropriate authorities. This involves providing detailed information about the installation and its production processes.

- Quarterly reporting: Exporters of cement sector products must submit quarterly reports of their GHG direct and indirect emissions.

- Official template: Exporters must use the standardised electronic templates provided by the European Commission to report their emissions data. These templates ensure consistency and accuracy in the reporting process.

- Specific requirements for cement: Operators must also adhere to specific guidances and calculation methods for different cement products to facilitate a seamless compliance journey.

All the standard regulations and rules for sectors covered under the CBAM during the transitional phase will become compulsory during the definitive regime. To understand more about phase-wise CBAM regulations common to all sectors, click here.

How to ensure CBAM-compliant reporting for cement?

CBAM reporting for export businesses and EU importers can be very taxing, complicated, time-consuming, and highly technical, as they must manage, measure, and process the massive amount of emissions data. Successful CBAM compliance will depend on high data accuracy and error-free activity-specific reporting methods. However, The Sustainability Cloud can help businesses in the cement sector eliminate all their sector-specific and process-specific challenges. The Sustainability Cloud’s CBAM reporting platform helps identify and create a CBAM-compliant product list. Its end-to-end platform can resolve challenges related to calculation methods for different inputs in any production process, data collection can be automated by ERP integration, and direct emission monitoring can be done by CEMS (Continous Emission Monitoring System).

FAQ

The reporting metrics for products under the cement sector is per tonne of goods, and the greenhouse gas covered is only the CO2.

Emissions covered for the cement sector during the transitional period and definitive regime are direct and indirect emissions.

On the basis of actual emissions, estimations (including default values) can be used for up to 100% of the specific direct embedded emissions for imports until 30 June 2024. Notably, default values can only be used until 31 July 2024. Moreover, default values can be used for around 20% of the total specific embedded emissions of complex goods for imports until 31 December 2025.

In the case of indirect embedded emissions, estimations (including default values), can be used for up to 100% of the specific indirect embedded emissions for imports until 30 June 2024.