CBAM is one of the most complex compliances, and everyone is new to this ecosystem. Hence, starting CBAM reporting early with accurate CBAM compliance software gives you a competitive advantage and keeps you ahead of other players in the market. It helps suppliers in multiple ways, including avoiding penalties, getting audits ready, and in the early detection of gaps for improved CBAM compliance reporting with CBAM as a regulation.

In this blog, we look at four reasons why you should start early CBAM reporting with CBAM report software:

1.Gaining competitive advantage

CBAM is a very technical and extremely complicated compliance that has strong potential to disrupt global trade and supply chains. From suppliers to importers, nobody has much experience and knowledge about CBAM compliance reporting. Hence, an organisation starting an early CBAM reporting journey with CBAM compliance software will be able to gain a competitive advantage over its peers by becoming the first to establish an accurate technical system to generate timely reports. Doing this will risk-proof businesses from suffering the economic costs of non-continuity in trade with the European Union. Moreover, companies with early reporting capabilities gain a competitive edge, as their commitment to sustainability appeals to environmentally-conscious markets and partners.

Benefits of CBAM reporting

- Leverage business security for existing operations EU: Early reporting for CBAM helps avoid financial implications and penalties for all the products and stakeholders involved.

- Gain customer loyalty and investor trust: The EU displays a greater inclination towards companies doing business in sustainable products and services. Hence, early CBAM reporting can have a direct impact on penetrating new businesses and expansion of existing businesses into the EU. For example, companies not conducting early CBAM reporting could lose business operations in the EU, while organisations with early CBAM reporting could gain customers’ and investors’ trust to grow. The customer base and investors’s trust increase due to sustainability efforts. This means more trust by both and more money in terms of investment and customer loyalty.

- Enjoy revenue generation due to early reporting: Early reporting can help you in generating revenue in comparison to rivals who are not CBAM compliant and have lost businesses. For example, more importers can come to you, who were until now dealing with your rival for more business than you. This means increased demand for your products, which generates more revenue. This is because the other rival company did not start early CBAM reporting but you did it on time accurately.

2.Audit readiness

Once the CBAM enters the definitive regime from 2026, auditing the emissions data by EU-accredited third-party auditors will become mandatory. Auditing depends on the accuracy of data, timely data submission, and maintaining a credible audit trail. These are only possible if suppliers start their CBAM reporting early.

3.Early detection of gaps for improved business efficiency

More emphasis should be placed on the accuracy of emissions data during the definitive regime. Early CBAM reporting helps improve the quality of data in two ways:

- Internal assessment after early detection gaps: Early data collection is key to seamless CBAM reporting, enabling timely error elimination and effective gap analysis. Streamlined processes for monitoring, reporting, and verification enhance efficiency, improve data accuracy, and reduce future administrative burdens, ensuring compliance with ease. For instance, a supplier proactively engaging in accurate CBAM reporting during the current Transitional Phase 1 positions themselves ahead of competitors who are delaying compliance or taking a minimal approach. This early alignment ensures a competitive edge when the definitive regime comes into force. Hence, early CBAM reporting ensures all the challenges and issues can be effectively and efficiently resolved during the pilot learning period without greater hurry, as could be the case during the definitive regime. Early CBAM reporting gives more time to rectify mistakes and chalk out strategies accordingly at an organizational level.

- Fine-tune business processes: CBAM mandates emissions data for categories under direct and indirect emissions besides precursor details. However, early emissions reduction depends on identifying different emissions hotspots and benchmarking emissions targets. Accurate tracking of emissions can lead to an early reduction of emissions, which means early energy-saving measures and improvement in business processes and efficiency. For instance, a company that identifies hotspots and reduces emissions can prevent the overuse of energy and adopt sustainable methods of energy consumption to save costs and avoid financial penalties under CBAM-similar compliances.

4.Stronger supply chain network

CBAM requires diverse data collection across the supply chain, demanding improved collaboration and timely course correction through gap analyses. For example, a supplier may face challenges obtaining precursor emissions data from a third-party supplier. This often occurs because third-party suppliers, not directly exporting to the EU, assume they are exempt from tracking and sharing their emissions data. As a result, the primary supplier’s reported emissions increase in the final CBAM submission.

Hence, early CBAM reporting is needed to collaborate and build a stronger supply chain network in which all stakeholders are more aligned. It also promotes collaboration across different teams, suppliers, third-party vendors and EU importers for efficient fulfilment of CBAM objectives. For instance, if there is a streamlined collaboration among all players, companies can provide emissions data for suppliers even if they don’t export directly to the EU, which can help in competitive supplier selection.

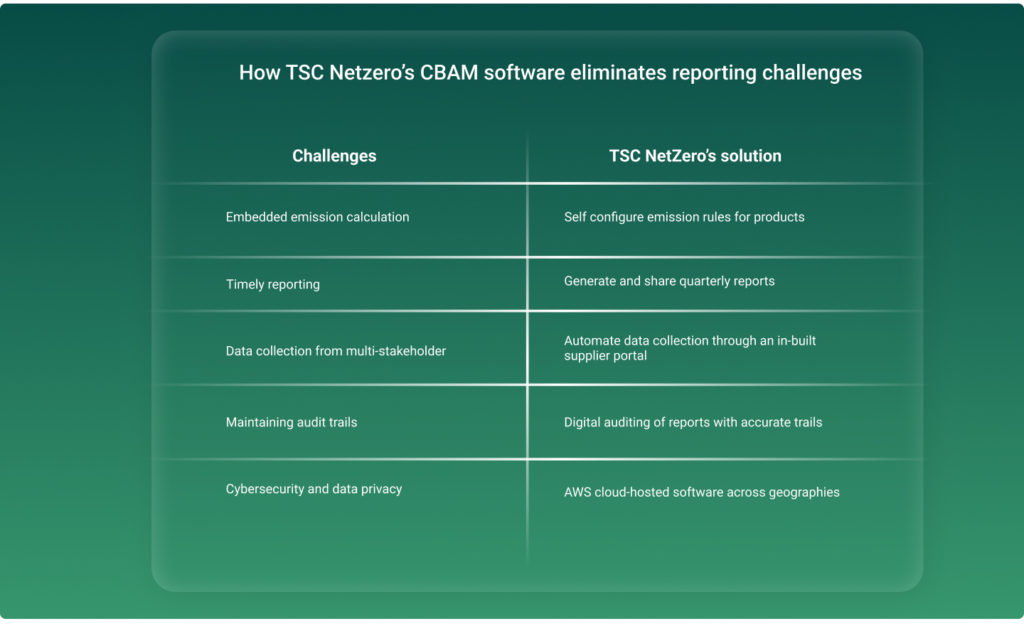

How does TSC NetZero help in CBAM reporting with CBAM compliance software?

The process of CBAM reporting is very difficult and tedious for both importers and exporters. This becomes even more challenging due to the fact that both entities are located in different parts of the world. The expansive nature of carbon tracing and accounting can leave little scope or time for teams to work towards decarbonisation. However, it can be executed easily in a timely manner through automation and digitization for seamless CBAM reporting with the aide of the right CBAM report software for EU importers and EU exporters.

TSC NetZero’s CBAM reporting tool for exporters facilitates flawless and automated data collection from each input and output of every process in a CBAM product’s production route. It also allows the generation of quarterly reports to be shared with EU importers on every shipment or invoice exported to the EU.

For EU importers, the CBAM report software solution allows end-to-end automation of data collection, forecast carbon tax and generate quarterly CBAM XML reports. One of the critical features is the consolidation of data from multiple suppliers for quarterly CBAM report generation in the .xml format provided by the EU.