The Carbon Border Adjustment Mechanism, which was introduced by the European Union to prevent carbon leakage, is a highly taxing and complex compliance. All non-EU exporters having export business with the EU are mandated to comply with CBAM and conduct CBAM audits. During the compliance journey, EU importers play a critical role in accurate CBAM reporting. Importers are responsible for ensuring accurate cross-verification and auditing for all emissions data submitted by the suppliers. However, this is one of the most challenging parts as it involves engagement with a number of stakeholders in the value chain, starting from the supplier’s side.

Managing, accounting for, and conducting CBAM audits of emissions data at such an enormous scale requires digital solutions that provide high-level accuracy. One of the primary functions of EU importers is to perform audits to assess the data quality and identify all discrepancies. CBAM auditing also depends on maintaining a proactive attitude regarding policy updates.

In this blog, we will take a look at 9 best practices for accurate CBAM emissions data auditing.

2 Major challenges in CBAM report auditing

CBAM report auditing can be highly taxing and challenging as it involves massive data management involving multiple stakeholders. Here is a look at two major challenges in CBAM report auditing:

- Data collection from multi-stakeholders: Gathering embedded emissions data of the product from the production process is a primary challenge for importers, who are physically not present at the installation. Due to the limited interactions between the importer and the non-EU exporter, restricted information reaches to the latter.

- Maintaining audit trails: The second challenge is maintaining the audit trails for the emissions data from the suppliers and third parties in the supply-demand value chain. Maintaining a credible trail is a very tedious process due to its complexity.

7 Best practices for CBAM auditing

Accurate CBAM auditing depends on EU importers performing the data quality assessment and identifying all the discrepancies in the report filing. Here are some of the best practices for EU-importers CBAM auditing:

1. Cross-verify

Cross-verification of emissions data helps in maintaining data accuracy and integrity throughout the value-chain, starting from suppliers to importers. EU importers should verify emissions data by comparing them against multiple sources at different stages and departments. This requires constant monitoring of reporting filing done from the exporters’ side and maintaining a consistent collaboration between the importers and non-EU exporters.

2. Maintain data procurement evidence

Importers should document their efforts to collect actual emissions data from suppliers and manufacturers. For instance, an importer must maintain all the formal records of any emissions data sharing communication with the suppliers. The record must include the date, time, and type of emissions data shared with the importer by suppliers. The focus should be on both the timeliness and the accuracy of the emissions data obtained from the suppliers.

3. Screening emissions data:

All the emissions data must undergo the screening process to ensure data accuracy. This must be performed to maintain accuracy for all the data received from third-party operators. Under the emissions data screening, importers must ensure that emissions data are accurate and aligned with EU-CBAM methodology. Under this, importers can ask for documentation details like calculation templates, data gathering systems, production processes, production routes, and precursors-related details.

4. Validating calculations

Meanwhile, just screening the data is not adequate as the success of a complete CBAM auditing also depends on accurate validations of calculation methods for reaching those conclusions about the data set. Validation of the accuracy of calculations and measurements of emissions data is critical. There are different ways to calculate the supplier’s embedded emissions data, and the importer must be in alignment with the exporter on this.

5. Digital monitoring systems:

Importers should set up digital systems and software to monitor, measure, and report carbon emissions in accordance with CBAM regulations. They should opt for platforms with traceability and integration capabilities to streamline reporting without hassle.

6. Maintaining elaborate documentation

EU importers should meticulously maintain detailed documentation related to records of energy consumption, production data, timelines of submitted data, reasons given for delayed submission if applicable, and emission factors. All this documentation must be auditable, traceable, and accessible to CBAM auditors.

7. Collaboration between importer and exporter:

Keeping communication lines open and active between the importer and the non-EU exporters eliminates discrepancies, delays, and scope of error related to CBAM reporting. Importers must be fully aware of the reporting requirements and data collection process on the suppliers’ side. This ensures less confusion and helps immensely in CBAM auditing.

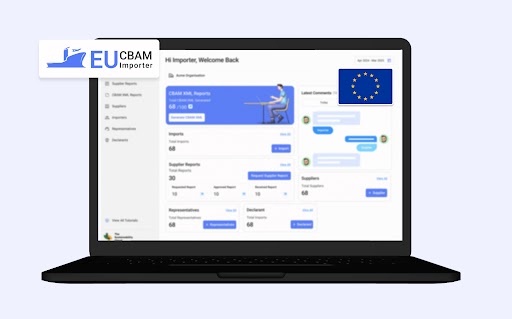

How does TSC NetZero help in CBAM Auditing?

Despite all these challenges and the complexities mentioned above related to CBAM report auditing, TSC NetZero offers some of the best features to eliminate all the setbacks in one place. It helps automate primary data collection through an in-built supplier portal. Moreover, it also offers live tracking of progress and streamlining of data collection with reminders and workflows. In addition to these, our platform ensures digital auditing of reports with accurate trails. There is also an integrated facility for third-party and first-party verification, as well as digitising the third-party audits by inviting EU-accredited auditors via TSC Netzero’s assurance modules.