India’s decision to establish its carbon market under its commitment to mitigating the climate crisis is unwavering, as it is emerging as a global sustainability leader, with its Greenhouse Gas Emissions dropping by a faster-than-expected 33 per cent over the past 14 years. Moreover, India is already on its way to achieving the United Nations Convention on Climate Change (UNFCCC) to cut down emissions intensity by 45% from 2005 levels to 2030.

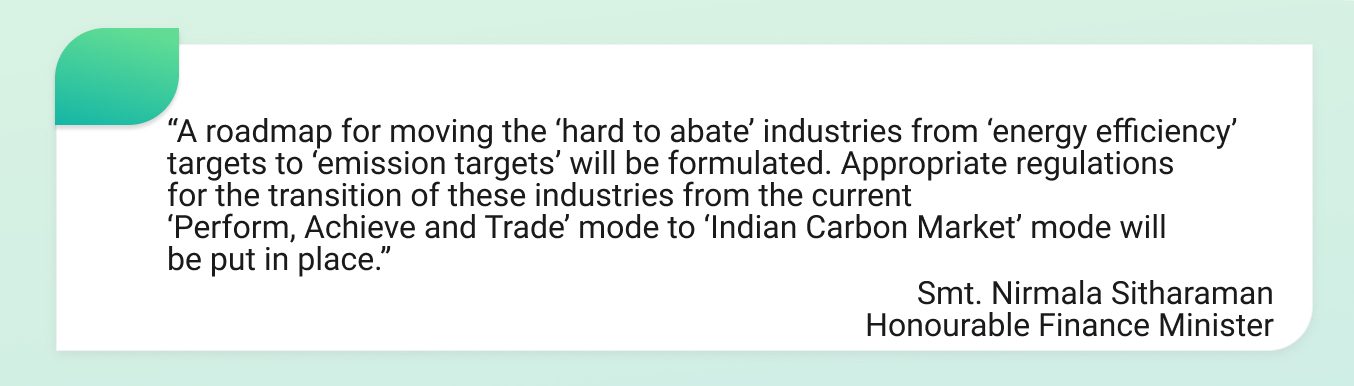

Indian Prime Minister Narendra Modi has also pledged to reach NetZero goals by 2070. India also ratified the Paris Agreement on Climate Change in 2016 to participate in limiting the global average temperature rise below 2°C by the end of the century. Moreover, India has also been on its mission to reduce GHG emissions by significant margins. During the budget 2024-2025 speech, Honourable Finance Minister of India Nirmala Sitharaman also highlighted the importance of developing a full-fledged Indian Carbon Market.

Despite being the world’s third-largest carbon emitter, India’s carbon market is in the nascent stages, which is undoubtedly full of great opportunities and possibilities. In the past few years, there have been trends and developments that highlight India’s commitment to developing mature market-based solutions to curb carbon emissions. The Indian Carbon Market seemingly aims to be among the top three global carbon markets by 2030. India is working towards developing its own carbon market as it is a very large market globally and intends to establish its own international trading rules. This comes as the world becomes more climate-conscious. But, carbon market without the critical role of carbon emissions monitoring and accounting tools will be void.

It is imperative that affordable and competitive technologies are encouraged as they will play significant role in driving innovation needed for carbon emissions monitoring, measurement and and accounting.

In this blog, we will take a look at the Indian carbon emissions market landscape and its future.

What is a carbon market?

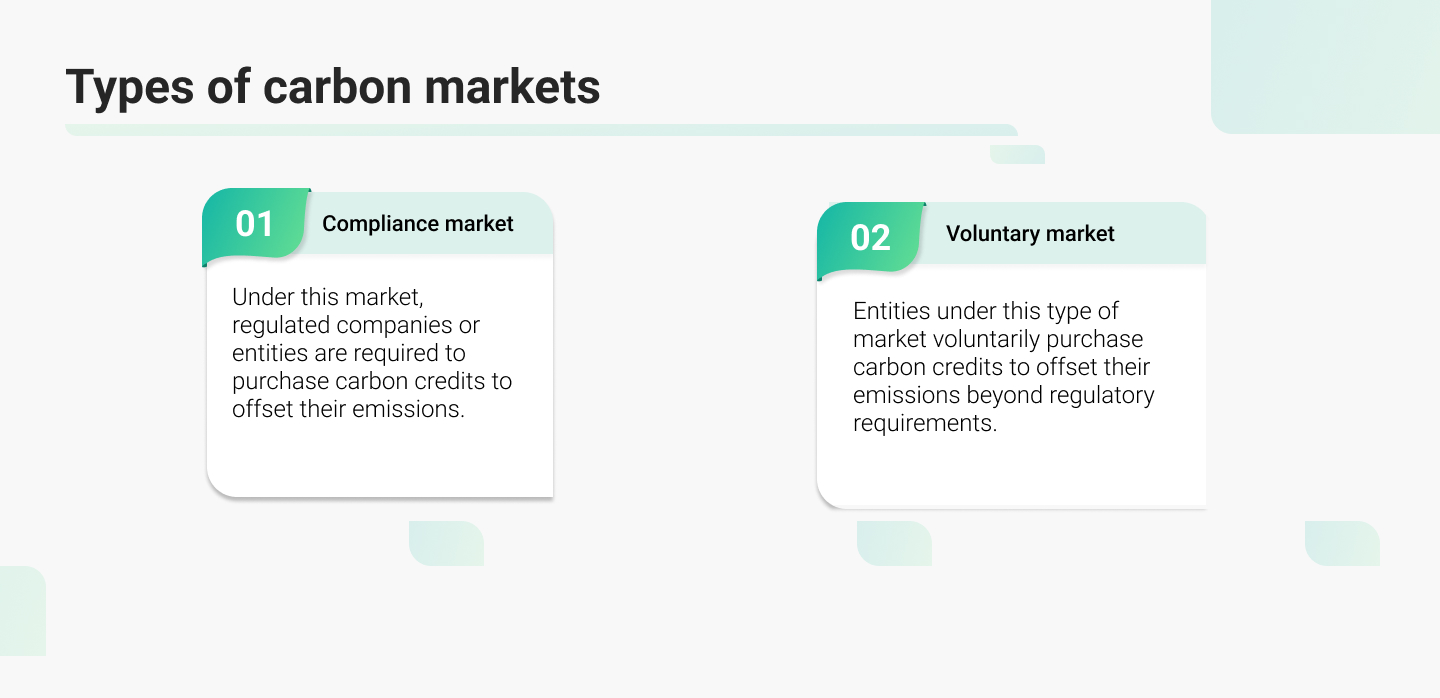

The carbon market is a market-based mechanisms designed to reduce greenhouse gas emissions by ensuring financial incentives for organisations to encourage them cut down their carbon footprint. The market functions on the principles of cap-and-trade, where a government or regulatory body sets a cap on the total amount of greenhouse gas emissions that are permitted within a jurisdiction.

Around 30 countries across the world have compliance carbon markets while others are following the voluntary carbon market. Countries such as Canada, China, the EU, Japan, the US and the UK have different systems of carbon markets. The valuation of compliance carbon markets is more than $850 billion, and around $2 billion for the voluntary markets. Carbon markets have multiple advantages that keep a company competitive. They ensure the channelling of financial resources to support emissions reduction and removal globally by allowing financial rewards for climate action. Concepts including carbon credits benefit indigenous communities and result in green job creation.

Does India have carbon market laws and regulations?

The Energy Conservation (Amendment) Bill, 2022, came into effect on January 1, 2023, after the Parliament of India passed the bill in both houses. This act by the government of India envisages provisions to develop India’s own carbon trading market. The law was framed to facilitate the installation of a carbon market in India. Under this law, multiple provisions mention a carbon credit trading scheme.

The Ministry of Power, on June 28, 2023, notified the regulations on the Carbon Credit Trading Scheme (CCTS), also called the Indan Carbon Market. Moreover, the Economic Survey of 2023-24 mentioned the “under the CCTS, the government shall set entity-wise GHG emission intensity targets to enable a per-output emissions limit in place of specific energy consumption targets under the PAT scheme.”

Emergence of India’s carbon market

Currently, the Indian carbon market is in its formative stages. It is still in the process of being completely formulated and will soon become a functioning compliance market. There are different initiatives and mechanisms that have been introduced to facilitate the gradual evolution of the Indian carbon market. Carbon pricing is the common theme of most of these schemes and initiatives, and it is a widely used tool across different carbon markets all over the world to ensure and encourage the reduction of carbon emissions. Here are some schemes in the Indian carbon market:

- PAT: India launched the Perform, Achieve and Trade (PAT) scheme in 2012 as its first step towards establishing a carbon market mechanism. It is a regulatory instrument to reduce specific energy consumption (SEC) in energy-intensive industries, with an associated market-based mechanism to enhance cost-effectiveness through certification of excess energy saving that can be traded. PAT is a mechanism designed to achieve the required energy efficiency in energy-intensive sectors. Energy consumption norms and standards are set by the BEE for intensive industry sectors. PAT scheme emphasises energy savings under the official Indian Carbon Market (ICM). However, the focus is now shifting to carbon emissions reduction targets. Under PAT, the organisations issued the ‘ESCerts’ are the Energy Savings Certificates issued by the Central Government in the Ministry of Power to the Designated Consumer under sub-section (1) of section 14(A) of the Energy Conservation Act, 2001. Research suggests that Indian units have saved over 106 million tonnes of CO2 emissions from 2015 till June 2024.

- Renewable Energy Certificates (RECs) System: This is market-based emissions reduction instrument that certifies the bearer owns one megawatt-hour (MWh) of electricity generated from a renewable energy source. The REC received can then be sold on the open market as an energy commodity once the power provider has fed the energy into the grid.

- Carbon Credits Trading Scheme (CCTS): In 2023, the government of India announced that it would introduce a Carbon Credit Trading Scheme by 2026. Thereafter, companies will be able to participate and trade carbon credit certificates (CCCs). Carbon credit trading refers to a system in which a single carbon credit represents the removal or avoidance of the emission of one tone of carbon dioxide. These credits then can be sold to an organisation that can claim the credit as a reduction in its own carbon emissions. The Bureau of Energy Efficiency and the National Steering Committee for Indian Carbon Market (NSCICM) are responsible for maintaining the integrity of carbon credits through monitoring, reporting and verification.

Who oversees the ICM?

Currently, India has no carbon tax. The Central Government constituted the National Steering Committee for the Indian Carbon Market (NSCICM) under the Carbon Credit Trading Scheme (CCTS). The NSCICM has been assigned the role of overseeing the functioning of the ICM. The Indian Carbon Market (ICM) could reduce the emissions intensity of its GDP by 45% by 2030 compared to the 2005 levels.

Technology’s role in India’s Carbon Market

The Indian Carbon Market can not be considered fully developed without the significant role of technology and carbon emissions monitoring and accounting tools. The right software that delivers data privacy and produces effective results while accounting, monitoring, and measuring carbon emissions is crucial in the entire carbon market ecosystem. Green and clean technologies could be critical in India’s carbon emission journey. The software used for carbon emissions monitoring, measurement, and accounting must be efficient and produce accurate emission data.

How is TSC helps enterprises on their carbon emission measurement journey?

Carbon accounting ensures transparency into an organisation’s environmental impact, helps identify areas for improvement, enhances stakeholder trust, and demonstrates commitment to sustainability goals. Moreover, any carbon management platform typically includes features including carbon footprint tracking, emissions reporting, sustainability goal setting, data analysis tools, and integration capabilities with other systems. The Sustainability Cloud’s carbon accounting tool is one such platform that has a pioneering and effective tool for tracking, measuring and accounting carbon emissions.

It is aligned with internationally recognised standards such as ISO 14064 for GHG accounting and reporting, GHG Protocol for corporate emissions reporting, as well as emerging frameworks like Carbon Border Adjustment Mechanism (CBAM) and Business Reporting on Sustainability and Climate Change (BRSR) for enhanced transparency and compliance with evolving regulatory requirements. TSC NetZero’s carbon accounting software ensures transparent and auditable accounting of Scope 1, 2, and 3 emissions, and it is aligned with GHG protocol and PACT standards. It focuses on digitising data collection, creating auditable and traceable carbon ledger.