Latest Post

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

Featured Post

Role of IoT in Manufacturing Industries

Manufacturing industries are filled with many challenges. Or we may say that the challenges

What is NetZero?

The earth’s temperature is rising. The result is erratic and uneven weather conditions resulting

Carbon Accounting: Everything you need to know

If businesses wish to improve their own production processes and activities while also taking

CBAM for cement sector: Guidelines for non-EU exporters and EU-importers

A detailed roadmap for non-EU exporters of cement products under CBAM to ensure accurate

CGWA guidelines for individual domestic consumers extracting groundwater for swimming pools

Vast extraction of groundwater reserves for swimming pools in residential areas are leading to

The Ultimate Beginner’s Playbook for Carbon Accounting for Companies

Carbon accounting plays an important role in reducing the environmental impact of any company

12 challenges faced by EU importers under CBAM

Carbon Border Adjustment Mechanism and 12 major challenges for EU importers and EU traders.

How early CBAM reporting for declarants and suppliers can protect and boost profits

CBAM is one of the most complex compliances, and everyone is new to this

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This is expected to disrupt global markets, particularly impacting developing economies reliant on exports in CBAM-regulated industries.

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

Common Mistakes to Avoid While Using A Carbon Accounting Software

As global trade considers embedded carbon, accurate carbon accounting is vital for compliance and continuity. Manual methods risk errors and inefficiencies, while software solutions streamline tracking, ensuring precise emissions reporting and regulatory compliance.

How EU Importers’ Reluctant Compliance to CBAM is Reshaping Trade and Revenue

EU importers are experiencing the administrative and economic impacts of the Carbon Border Adjustment Mechanism. In this blog, we will do a deep-dive analysis of how CBAM will impact your business as an importer in the EU.

The Ultimate Beginner’s Playbook for Carbon Accounting for Companies

Carbon accounting plays an important role in reducing the environmental impact of any company to help it achieve NetZero targets. Here is all you need to know about carbon accounting.

Omnibus package: Know new CBAM report filing and CSRD rules

With the introduction of the Omnibus package, global trade will witness changes and to some extent relief when it comes to CBAM reporting. It will certainly disrupt the supply chain, but not act as a hindrance to trade flows.

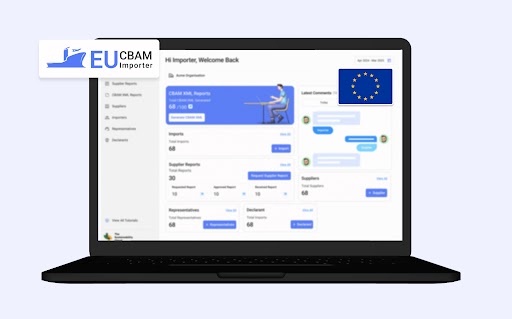

The Sustainability Cloud simplifies CBAM reporting for declarants in EU

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

One year of CBAM reporting for exporters: Key learnings and lessons

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase 1 implementation. This Phase has been particularly challenging for businesses and companies as most of them continue to adapt to CBAM. In this blog, we will discuss key learnings from CBAM implementation.

6 questions every declarant needs to ask before selecting a CBAM importer tool

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly report generation. The right evaluation of CBAM software depends on factors such as complexities, data collection and accuracy, among others. A look at 6 questions to consider while evaluating the CBAM reporting tool for importers.

News and media

Aluminium sector needs to look beyond adopting low-carbon energy solutions

LogicLadder secures $2.5 mn funding from BIG Capital and Zerodha’s Rainmatter