Latest Post

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

Featured Post

Step-by-step guidebook for data management by EU importers

Managing emissions data is a complex challenge for EU importers, as the process involves

Omnibus package: Know new CBAM report filing and CSRD rules

With the introduction of the Omnibus package, global trade will witness changes and to

Latest CGWA Guidelines on Groundwater Monitoring

This article will share details on the Latest CGWA Guidelines issued by the regulatory

CBAM rules for hydrogen and fertiliser sectors

CBAM for hydrogen and fertiliser: Specific monitoring, reporting and verification rules for different production

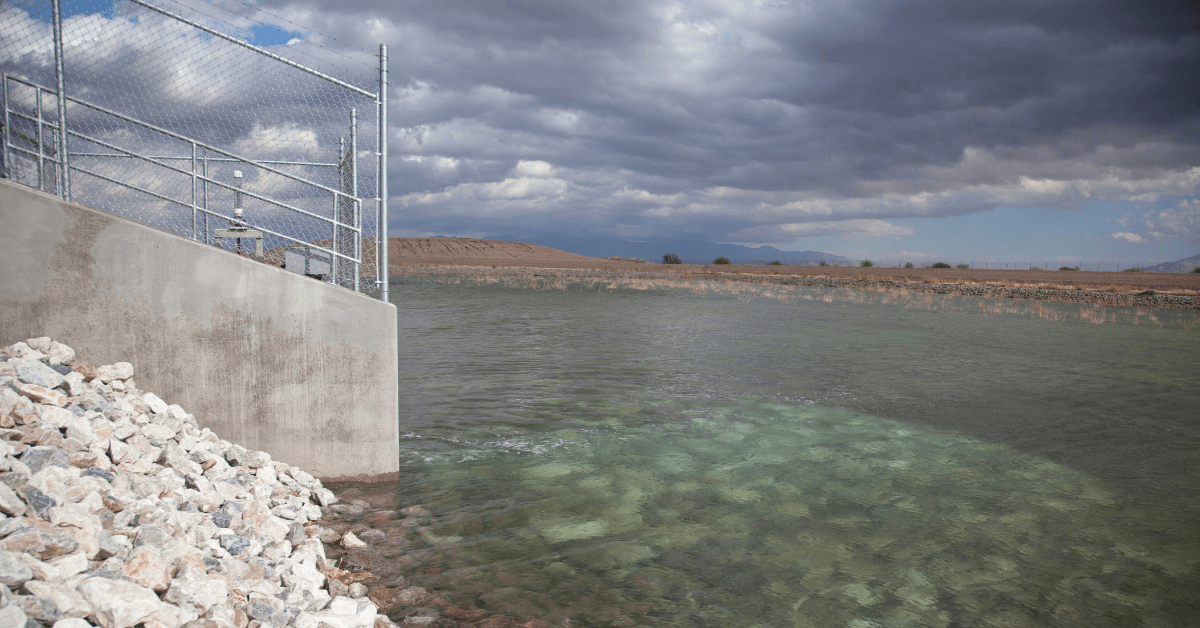

Artificial Recharge of Groundwater

The growing demand for groundwater due to the ever-rising global population has encouraged us

12 challenges faced by EU importers under CBAM

Carbon Border Adjustment Mechanism and 12 major challenges for EU importers and EU traders.

Latest CGWA Guidelines on Groundwater Monitoring

This article will share details on the Latest CGWA Guidelines issued by the regulatory

LogicLadder awarded at BIXPO 2017

LogicLadder awarded at BIXPO 2017, Gwangju, South Korea We are proud to announce that LogicLadder has

CSRD reporting decoded – Understanding the 3 Ws and H

The European Union Commission introduced the Corporate Sustainability Reporting Directive (CSRD) in 2023. Under this framework, large and listed companies are required to publish regular reports on the social and environmental risks they face.

CBAM Reporting: Steps to request delayed CBAM report submissions

Importers and exporters facing issues in submitting the quarterly CBAM reports can now request delayed submission due to technical errors. Here is a look at the regulations on how importers can apply for delayed CBAM report submissions.

India’s carbon market revolution: sustainable growth with climate-conscious economy

A bird’s eye view of how India is establishing its own carbon market and why is it an important step in carbon emission accounting to meet its NetZero 2070 targets.

12 challenges faced by EU importers under CBAM

Carbon Border Adjustment Mechanism and 12 major challenges for EU importers and EU traders. This blog identifies all significant challenges that an importer of goods entering the European Union faces during the Transitional Phase 1 and Definitive Regime with emphasis on the EU’s supply chains.

CIO’s guidebook to buy sustainability management software

CIOs face challenges in selecting sustainability management software by evaluating its effectiveness in meeting environmental goals. Key parameters include industry fit, software efficiency, integration capabilities, and ease of use. They must also consider how well the tool aligns with company-specific sustainability objectives and overall IT functions, ensuring it helps accurately measure and reduce environmental impact.

Scope 3 emission accounting for upstream and downstream activities

Scope 3 emissions could soon become mandatory as they represent over 75% of the total GHG gas emissions of a company. Hence, it is imperative that organisations start strategising for Scope 3 emissions measurement.

CBAM rules: How importers need to file their CBAM report

CBAM rules for using the specific reporting template are different for importers and suppliers. CBAM rules for using the specific reporting template are different for importers and suppliers. An exporter from outside the EU is mandated to provide details of the embedded emissions, production routes and production processes. Here is a look at steps needed to submit the CBAM report.

Aluminium sector needs to look beyond adopting low-carbon energy solutions

In an insightful interview with AlCircle, Mayank Chauhan, co-founder and CEO, LogicLadder Technologies, discusses how the Indian Aluminium sector is integrating sustainability into its operations.

How to select a CBAM reporting software? 5 things to consider

Best CBAM reporting software for end-to-end compliance journey for EU importers and non-EU exporters.