Latest Post

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

Featured Post

One year of CBAM reporting for exporters: Key learnings and lessons

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase

Why a low-cost gateway in an IoT project does not make any sense?

An IoT Gateway is an integral part of any IoT application/project. So, it’s important

Stack Emission Monitoring

You might not be surprised knowing that out of the 30 most polluted cities

CBAM reporting essentials every non-EU exporter must know

An outline of guidelines and compliances that must be followed by non-EU operators under

Top 5 must-have features of an ESG management software

ESG, which stands for Environmental, Social and Governance, has been gaining unprecedented significance over

Partnership for carbon transparency (PACT): 4 things you must know

A detailed overview of Partnership for Carbon Transparency (PACT) and its vision to ensure

Latest CGWA Guidelines on Groundwater Monitoring

This article will share details on the Latest CGWA Guidelines issued by the regulatory

LogicLadder was chosen by NASSCOM among the Top 10 start-ups of India.

LogicLadder has been selected in the“League of 10” by Nasscom. The award was presented to

CBAM Reshaping Global Trade: Where Does India Fit Into Changing Business Ecosystem?

The Carbon Border Adjustment Mechanism (CBAM) is set to reshape global trade by prioritising climate risks in business operations. This is expected to disrupt global markets, particularly impacting developing economies reliant on exports in CBAM-regulated industries.

5 Insider Tips for Business Carbon Accounting You Need To Know

Discover 5 extremely important tips to master business carbon accounting from data integration to software selection.

Common Mistakes to Avoid While Using A Carbon Accounting Software

As global trade considers embedded carbon, accurate carbon accounting is vital for compliance and continuity. Manual methods risk errors and inefficiencies, while software solutions streamline tracking, ensuring precise emissions reporting and regulatory compliance.

How EU Importers’ Reluctant Compliance to CBAM is Reshaping Trade and Revenue

EU importers are experiencing the administrative and economic impacts of the Carbon Border Adjustment Mechanism. In this blog, we will do a deep-dive analysis of how CBAM will impact your business as an importer in the EU.

The Ultimate Beginner’s Playbook for Carbon Accounting for Companies

Carbon accounting plays an important role in reducing the environmental impact of any company to help it achieve NetZero targets. Here is all you need to know about carbon accounting.

Omnibus package: Know new CBAM report filing and CSRD rules

With the introduction of the Omnibus package, global trade will witness changes and to some extent relief when it comes to CBAM reporting. It will certainly disrupt the supply chain, but not act as a hindrance to trade flows.

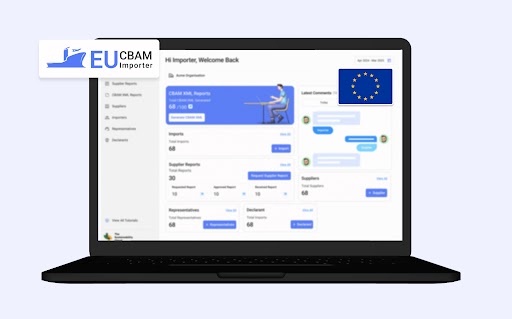

The Sustainability Cloud simplifies CBAM reporting for declarants in EU

Crafted for CBAM declarants, the software is designed to provide easy CBAM reporting solution for the EU’s €6.57 trillion import market.

One year of CBAM reporting for exporters: Key learnings and lessons

The Carbon Border Adjustment Mechanism has completed over 1 year of ongoing Transitional Phase 1 implementation. This Phase has been particularly challenging for businesses and companies as most of them continue to adapt to CBAM. In this blog, we will discuss key learnings from CBAM implementation.

6 questions every declarant needs to ask before selecting a CBAM importer tool

EU importers need a CBAM reporting tool to eliminate multiple challenges related to quarterly report generation. The right evaluation of CBAM software depends on factors such as complexities, data collection and accuracy, among others. A look at 6 questions to consider while evaluating the CBAM reporting tool for importers.

News and media

Aluminium sector needs to look beyond adopting low-carbon energy solutions

LogicLadder secures $2.5 mn funding from BIG Capital and Zerodha’s Rainmatter