EU CBAM for importers are going to be under increasing pressure as the CBAM implementation keeps getting stricter. The impact will most probably be felt in the supply chain flow network, a number of imported goods, and revenue generated in the EU market from imported products. These challenges can get further enhanced when manually handling data from suppliers and not depending on effective CBAM importer tool. Additionally, ensuring that the data is accurate is time-consuming and prone to errors. Automation can go a long way in eliminating these roadblocks. Software-based automation for quarterly CBAM report generation can save time and effort by 80 per cent.

However, finding the right software to simplify your CBAM reporting is critical. Here are 6 questions every importer must ask before selecting a CBAM reporting software.

Will EU CBAM for importers tool help me collect data from suppliers globally?

Importers who are located in the European Union have restricted contact with the suppliers due to different geographical location of both the entities. Importers sitting in the EU have the responsibility of collecting data from multiple suppliers from different countries across the globe. For instance, two different suppliers sitting in India and South Africa will have different challenges when it comes to sharing the data with their importers. To eliminate this challenge under the CBAM reporting compliance, importers and exporters must be in consistent communication.

A tool allowing constant communication between the supplier and the importer to generate reports at the import level and quarterly level is highly desirable. Most details about the supplier should be gathered in terms of their operations, production routes, production process and installations. Tracking all these data points, including the precursor’s details, could act as a massive catalyst in eliminating maximum gaps between the importer and exporter.

How does CBAM importer tool ensure audibility and accuracy of the collected data?

Cross-verification of emissions data and EU-accredited third-party data verification are very important for CBAM reporting. The CBAM tool must be able to manage, calculate, validate and store the data in an organised fashion. These records of evidence can be used during the third-party EU-accredited auditing once the CBAM enters definitive regime from 2026. It is very important to maintain all trails related to data sharing and verification for future auditing purposes.

Hence, a CBAM reporting tool must-have features to diagnose, locate and identify any inaccuracies or miscalculations in the reports shared by the supplier. Moreover, the importer should be responsible for conducting a proper cross-verification of emissions data. An effective CBAM reporting tool can streamline the entire process of communication and collaboration between importers and exporters.

How will the CBAM tool help me as an importer in data accuracy?

The focal point of accurate CBAM reporting is accurate data collection and high accuracy. As an importer, it is your responsibility to maintain the accuracy of the emissions data shared by suppliers. Moreover, you have to deal with all kinds of data and should prefer a CBAM reporting tool that can streamline gathering emissions data from suppliers, calculating embedded carbon, and generating the necessary reports for authorities. There are two primary aspects related to data accuracy:

- Administrative burden: Importers are responsible for managing a massive amount of data that has multiple stakeholders. Hence, a digital tool designed for EU importers can minimise most of the administrative burden and automate the workflow, saving time and resources.

- Transparency and accountability: Maintaining data integrity and accuracy for accountability is imperative for supply chain transparency. To achieve transparency in data management, data shared by suppliers must be kept in an organised fashion without any major errors. A digital tool assists in enabling clear documentation of carbon emissions associated with imports, enhancing transparency in the supply chain.

- Hotspots for data inaccuracies: CBAM importers are highly dependent on their suppliers for all the emissions data and have no direct control over the data-gathering process by the exporter sitting outside the European Union. This makes them highly responsible and potentially liable for any error under the CBAM regulations. Moreover, an inbuilt feature in the EU CBAM tool must be able to identify, locate, and flag any hotspots for inaccuracies in the CBAM report submitted by the supplier.

- Fudged emissions data by suppliers: Many exporters do not have a proper technical setup or installation to generate specific emissions data. Consequently, importers also get fudged emissions data from suppliers, which creates data credibility issues. The CBAM tool must analyse the emissions data and spotlight if the data is fudged by comparing it with default values given by the EU. The live comparison of emissions data against the some credible and standard emissions factor dataset can help develop high-quality data credibility.

How can I automate CBAM reporting as an importer?

Managing massive emissions data and reports shared by suppliers is an actual task that requires automation from an importer’s side. It is manually not possible to constantly gather, validate and store reports from multiple suppliers from different countries acros the world. Manual management of data and reporting them as an importer is full of scope for data losses, inconsistencies and high chance for reporting errors. For instance, an importer managing the data received from the supplier can also lose some datapoints during the time of data exchange and transferring them into importer-specfic reporting templates.

Moreover, manually sending emails to suppliers for any clarification or CBAM reporting-related concerns is tedious. Hence, a CBAM reporting tool that can automate the communication channels between the importers and exporters, raise queries to all the stakeholders simultaneously and keep them all on the same page is needed. Automation helps in efficient data collection from suppliers, notifying them of quarterly deadlines and generating reports on time without much human intervention.

Can the CBAM tool help in filing one XML for multiple importers?

Under the CBAM, one XML can contain information of multiple importers. Hence, any CBAM tool for importers should allow the filling of one XML report for multiple importers. For instance, customs handling agents, who are officially known as indirect representatives under the CBAM, get multiple reports from suppliers for multiple importers. Hence, one XML report should be filed for multiple importers.

How will I know if the CBAM report generated by the tool will be accepted by NCA?

CBAM is highly technical and difficult compliance to follow. As an importer, you are responsible for submitting the correct CBAM report and ensuring the data accuracy for reports shared by your supplier. Moreover, the CBAM report containing accurate emissions data, timely and relevant information in given template, adherences to all the compliances and past history of CBAM reporting with suppliers among other factors increases chances for the report to be accepted by the NCA.

A CBAM reporting tool must be able to allow you to live-track and monitor all reporting requirements that are being met through the CBAM tool you have selected. A dashboard of report generation gives all the details and allows you to compare all the reporting checklists against the CBAM compliance.

Moreover, CBAM is new for both importers and exporters, and the compliance keeps updating with new guidelines. A dedicated tool must be able to integrate new changes in the CBAM compliance journey as required. It must allow comparison of CBAM rules against the adherence checklists, and notify any changes to the importer.

How The Sustainability Cloud’s CBAM tool helps EU importers?

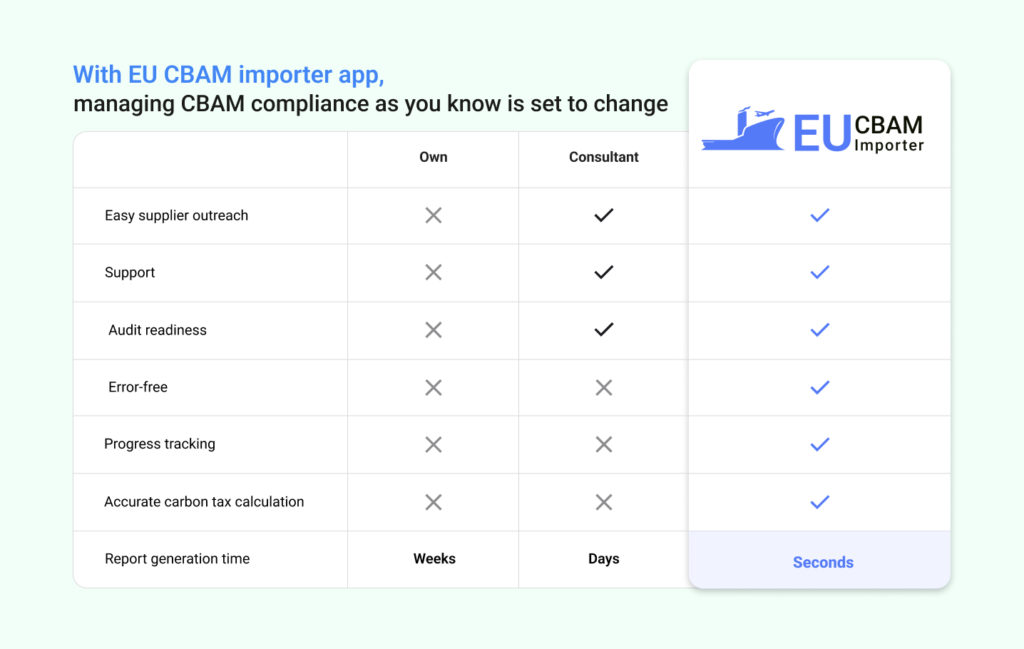

The Sustainability Cloud has designed a special and faster CBAM importer tool for EU importers. It ensures automated end-to-end CBAM compliance for decarbonising the full supply chain, predicts carbon tax and generates quarterly CBAM XML reports.

One-tap supplier outreach

Importers can request multiple CBAM reports and embedded emissions data from multiple suppliers from anywhere in the world. There can be constant communication between the supplier and the importer to generate reports at the import level and quarterly level.

Easy supply chain emissions tracking

With this feature, you can track the progress of supplier CBAM reports and collaborate with them using comments, reminders and approval-rejection workflows.

Audit-ready XML report generation

The EU CBAM importer tool allows the preparation of consolidated data from many suppliers to generate quarterly CBAM reports in the XML format provided by the EU.

Assurance module for EU-accredited verifier audits

The assurance module helps maintain audit trails across the supply chain. It also simplifies EU-accredited verifier audits for mandatory third-party auditing from a definitive regime.

Risk mitigation through carbon tax forecast

The CBAM reporting tool also helps in minimising financial impact and future risks by estimating carbon tax costs.

Analytical supply chain decarbonisation

The Sustainability Cloud’s CBAM reporting solution also helps in analysing and identifying carbon-intensive imports and suppliers to decarbonise the supply chain based on the CBAM emission data.

In addition to all these integrated features, EU importers must also have the ability to update and integrate new compliances for smoother functions. For instance, CBAM is a new compliance for everyone, and the rules keep changing constantly. In such a scenario, it is important to have a CBAM reporting tool that can allow the integration of new compliances. Moreover, the importer CBAM tool also has to ensure tracking of carbon emissions tax paid by their suppliers in the country of their origin. The tool must eliminate all challenges related to ensuring the completeness of the imports list and other relevant factors that must be included in the CBAM report.