Blog Summary: As the world becomes more carbon-conscious, the European Union introduced the Carbon Border Adjustment Mechanism to promote cleaner production and regulate carbon emissions for products that enter its territory. CBAM is a highly technical and complicated carbon-tax system, and slowly, it will apply to all products under the EU ETS. Naturally, the CBAM reporting tool must be highly efficient and effective. This blog is about selecting the best CBAM reporting software for end-to-end compliance journeys for EU CBAM importers and non-EU exporters.

The Carbon Border Adjustment Mechanism (CBAM) was introduced in May 2023, it was developed to promote fair competition and motivate carbon emission management. CBAM ensures importers and non-EU operators bring products into the EU market that comply with carbon regulations. It is the EU’s tool to put a fair price on the Carbon emitted during the production or manufacturing of Carbon-intensive goods outside the EU that are entering the EU’s markets for trade. Therefore, it is imperative that exporters outside the EU comply with CBAM for trade continuation. However, this has also mandated the need for them to select the best CBAM reporting software that calculates the embedded emissions of products accurately.

CBAM’s varying reporting and monitoring requirements for six different sectors make the entire implementation process very taxing and complicated. There are multiple rules and regulations for CBAM implementation during the Transitional Phase 1 and the Definitive Regime. There are different monitoring requirements for an organisation’s emissions data for the purpose of submitting quarterly reports. Companies are also required to submit the quarterly reports in specific templates and formats provided by the EU for error-free CBAM implementation. In this scenario, it becomes necessary to look for a suitable CBAM reporting tool that eliminates all the challenges for six sectors and their sub-categories.

Due to the high complexity in sector-specific emission monitoring requirements, CBAM compliance becomes a very time-consuming and highly taxing affair. Generating accurate emissions data is an uphill task as an organisation must have a set-up ready to manage and process such a high amount of data.

In this deep-dive blog, we will look at details of the factors and features for the best CBAM reporting software and how to choose the best tool.

CBAM reporting software features to consider before purchase

Selecting a good CBAM reporting software is crucial to accurate compliance adherence. Moreover, as the stakes are high, the companies must go for the best tool that offers all-in-one services. Let’s look at some very important factors and features that must be considered while finalising the CBAM reporting tool:

- Accurate emissions data: Any CBAM reporting software must have an inbuilt mechanism to ensure highly accurate emissions data gathering, processing and compiling them in the specifically designed template. The success of CBAM compliance depends on correct emission data.

- Timely reporting: Every non-EU exporter (supplier) has to submit timely emissions reports to the importers in the EU to facilitate CBAM reporting on time. For instance, steel exporters operating in India must give their emissions data to the importer for quarterly reporting of the CBAM.

- Correct data collection from multiple stakeholders: One of the very important features of the best CBAM reporting software is to be able to collect data from multiple stakeholders for the reporting company. The software must have an integrated feature to produce all data from different production routes and processes for different products and their sub-categories at one place.

- Strict adherence to specific MRV requirements: CBAM has specific monitoring, reporting and verification requirements for different sectors. Hence, any CBAM reporting software must have self-configure emission monitoring features for different products and sub-categories.

- Maintaining a record of carbon tax paid: The software must also maintain a robust record of carbon tax paid along the way in the country of origin to avoid being double taxed under the CBAM. As the entire Carbon Border Adjustment Mechanism is a completely new concept, every stakeholder is getting acquainted with it on a regular basis. Even the EU keeps introducing new rules, regular updates and corrections to its existing guidelines. Hence, the CBAM reporting tool should also have built-in features to allow for the integration of new reporting guidelines, if applicable.

- Software for all CBAM phases: Reporting and monitoring rules change during the Transitional Phase and the Definitive Regime. Currently, CBAM is in the transitional phase and is focused on learning more about the mechanism. A software must be able to eliminate all challenges related to accurate reporitng and must focus on making the company CBAM compliant from the start itself.

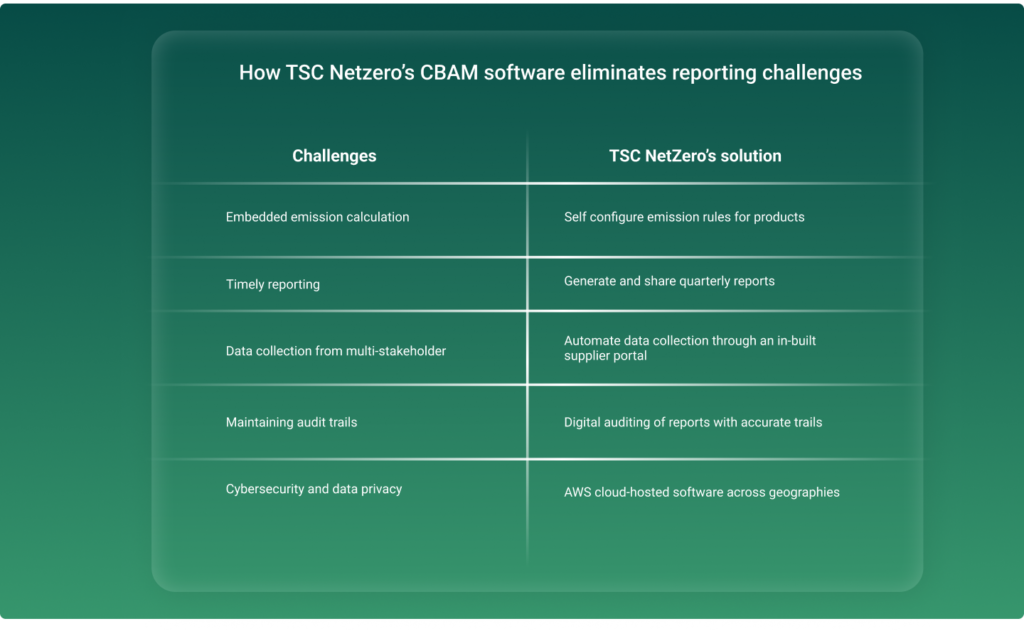

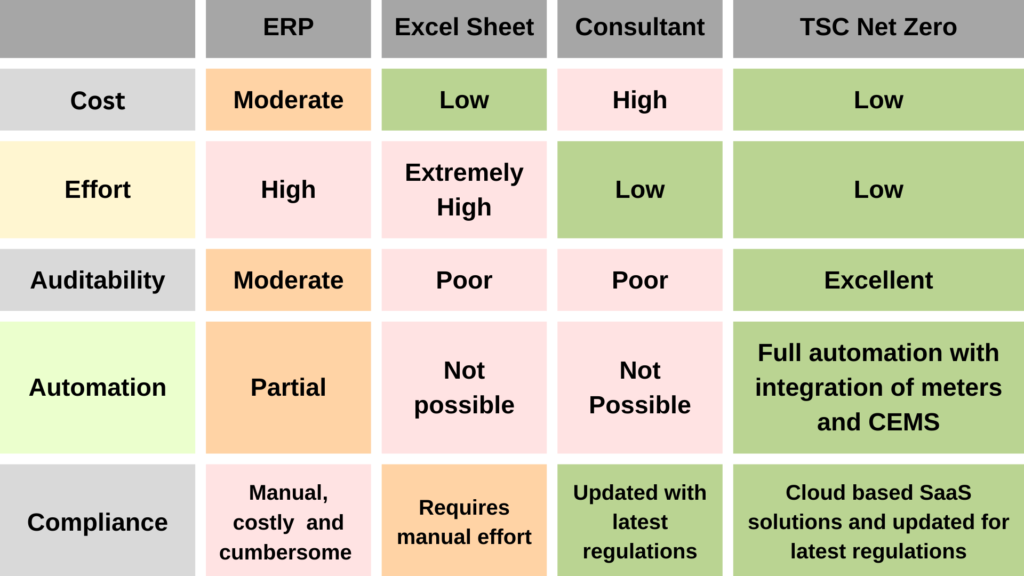

CBAM regulations are very complicated to understand and implement. Most firms don’t even know about all the highly complex rules and technicalities of the CBAM. The most effective way to implement CBAM is through the digitisation process. The firms need product such as the TSC Netzero’s CBAM software, which offers solutions to all challenges at one platform without any hassle.

How is TSC Netzero helping firms become CBAM compliant?

Any organisation is estimated to take about 8-12 months to reach the stage of being fully prepared to attain the position of becoming CBAM compliance-ready. The Sustainability Cloud provides the end-to-end implementation and digitisation of CBAM rules and regulations. There are three milestones or targets that need to be achieved to become CBAM compliance-ready with the help of our software and product services, which are designed in great detail.

- Setting up CBAM

The first step involves digitising your CBAM reporting process through TSC Netzero. This includes establishing reporting periods, identifying CBAM products and mapping their production processes and production routes, and finalising monitoring needs and methods. All these initial stages establishing CBAM compliance are digitised and taken care of by TSC Netzero.

- Data collection, product and process emission calculations

The next step is to ensure proper and accurate data collection and Carbon emissions calculations, which TSC boasts of having expertise in. We offer complete services for automated data collection from meters, CEMS and ERPs. The TSC also eliminates challenges such as Scope 1 and 2 calculations in compliance with CBAM requirements, maintaining carbon tax records in your value chain, and auditable records with details of emissions factors, methodologies, etc.

- CBAM emission reporting

In the final stage of CBAM compliances, emissions are attributed and reported. We provide end-to-end solutions to this too in the form of rule-based emission attributions and intensity calculations. An automated report will be generated in CBAM format at invoice or shipment level.

Why choose TSC Netzero’s CBAM software?

The TSC NetZero’s CBAM reporting software eliminates challenges such as accurate data collection and calculation of embedded emissions that can reduce your overall product price in EU markets. Another challenge is that our software can help eliminate delays in timely reporting of carbon emissions in order to avoid penalties. Further, we provide the best auditing through our product designed to help firms in preparing digital audits of carbon emissions in less time and with greater confidence.

The TSC Netzero’s CBAM reporting software offers a 6-month free trial for organisations to calculate embedded emissions. Its advanced CBAM reporting software helps in manual and automated data collection for each input and output of every process in a CBAM product’s production route.

TSC NetZero’s CBAM reporting software is the best in the market, and it ensures accurate product-embedded emission calculations at product and process levels. It also assists in quarterly emission report generation by digitising the entire process. All other reporting and monitoring requirements, such as data collection for suppliers and high auditability of data, can be done by TSC NetZero’s CBAM reporting software. Moreover, it also supports the tracking of carbon taxes paid along the supply chain.