The Carbon Border Adjustment Mechanism (CBAM) was introduced by the European Union to encourage fair trade competition and control the embedded carbon emissions of the products entering its markets. As the world’s first carbon tax, it was rolled out in in 2 phases-Transitional Phase and Definitive Regime. Post July 31, 2024, a drastic change a CBAM change has been incorporated – discontinuation in the use of CBAM default values.

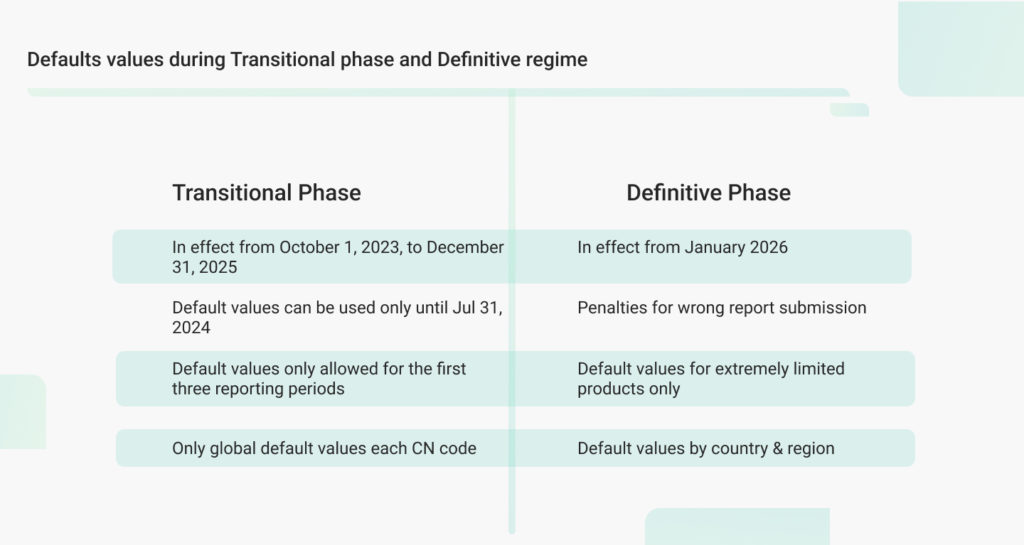

The aim of introducing the Transitional Phase 1 of CBAM, running from October 1, 2023, to December 31, 2025, was to focus on knowledge-sharing about CBAM regulations for carbon-intensive sectors in the EU, non-EU countries, and other stakeholders. During this phase, stakeholders must report the GHG emissions embedded in their imports, including direct and indirect emissions, without needing to buy or submit certificates. This phase allows businesses time to prepare for the definitive CBAM regulations. However, some significant emissions monitoring and reporting rules have changed for importers during the transitional period.

Importers and non-EU exporters will be unable to use default values to report their embedded carbon emissions after July 31, 2024, under the CBAM reporting obligations. Previously, businesses of six sectors such as iron and steel, cement, electricity, hydrogen, fertilizer, and aluminium could use the default values while submitting their quarterly reports. Now, importers must use actual emissions to adhere to reporting requirements under the CBAM. They must be able to acquire all the necessary emissions data from the manufacturers of the products they are importing.

In this blog, we will explore what changes after July 31 for importers and non-EU exporters of CBAM products.

Importers can not use default values after July 31

The European Union Commission limits the use of default values for importers. Until July 31, importers could use default emission values for usage in the first three quarterly CBAM reports without a quantitative limit. As per the CBAM reporting guidance document, the reporting declarant was permitted to use other methods to determine emissions, including default values made available and published by the EU. However, as CBAM enters the transitional period, only global default values will be allowed for each CN code under the CBAM reporting requirements.

For instance, a non-EU exporter of steel products sitting in India could use the default values for emissions reporting until July 31, 2024. But now, you, as a non-EU exporter, must use accurate emissions data for quarterly report submission. This development in the limitations for the use of default values arose from the fact that importers never asked for accurate emissions earlier. Previously, non-EU exporters never bothered to track, measure and gather embedded emissions.

Default value means a value that is calculated or drawn from secondary data, which represents the embedded emissions in goods. The EU has given emission value limitations for each sector. The Default value is the intensity of emissions. It expresses the quantity of CO2 emissions per measurement unit of product.

Default values and exceptions under CBAM

There are exceptional situations where default values (estimated values) can be used for reporting up to 20% of the total embedded emissions only for complex goods. However, this will have quantitative limitations but no time limit. Moreover, using default values provided by the Commission would qualify as ‘estimation’.

In other words, it means that 100% of the total embedded emissions may be determined using default values until June 30, 2024. For the remaining transitional period (i.e. for imports from 1 July 2024 to 31 December 2025), estimated values may be used but a quantitative limit is applied for complex goods.

Transitional Phase Vs Definitive Phase of CBAM

There are different default values for different CN codes as per varying products under the CBAM. These values change as per the type of products, and their sub-categories. Here is the link to the default values for the transitional period of the CBAM. Moreover, the use of default values also changes during the transitional period and definitive regime.

Penalties for using default values after July 3

Importers who don’t submit the compulsory quarterly emissions report during the transition period or use default values for their imported products can face penalties ranging between EUR 10 and EUR 50 per tonne for failure to report emissions. The penalty is imposed by the National Competent Authority (NCA), which vets all submitted reports. It can take appropriate actions against organisations in issues related to false, incomplete or no CBAM reports. The NCA can also impose penalties if the “reporting declarant has not taken the necessary steps to comply with the obligation to submit a CBAM report”.

How does our CBAM solution help you?

CBAM reporting for export businesses and EU importers can be very taxing, complicated, time-consuming, and highly technical, as they must manage, measure, and process the massive amount of emissions data of their products. Successful CBAM compliance will depend on high data accuracy and error-free activity-specific reporting and monitoring methods.

There are different default values for different sectors, and efficient tools are needed for the most accurate emissions data reporting. However, The Sustainability Cloud can help businesses eliminate all their sector-specific and process-specific challenges. The Sustainability Cloud’s CBAM reporting solution helps identify and create a CBAM-compliant product list. Its can resolve challenges related to calculation methods for different inputs in any production process, data collection can be automated by ERP integration, and direct emission monitoring can be done by CEMS (Continous Emission Monitoring System).