Two major industries that fall under the regulatory purview of EU’s Carbon Border Adjustment Mechanism during the transitional phase are Aluminium and Electricity. For Non-EU exporters both sectors impact a sizeable portion of the import-export business. As per the World Bank data, Russia exports 40.0% of aluminium to the EU, followed by Kazakhstan at 42.1%, China at 13.2%, and India at 9.1%.

One of the primary challenges faced by exporters is ensuring accurate embedded emissions data collection, management, measurement, and reporting to importers. For the aluminium and electricity sectors, different rules exist reporting under CBAM. Here’s briefly looking at how the two sectors need to meet the compliance.

CBAM reporting for aluminium sector

CBAM’s complex nature makes it imperative for aluminium producers to be well-versed in reporting requirements. The CBAM Guidance document highlights that exporters of products in the aluminium sector should account for direct and indirect emissions during the transitional period. The emissions data should be calculated for the specific installation or production process in the country of origin.

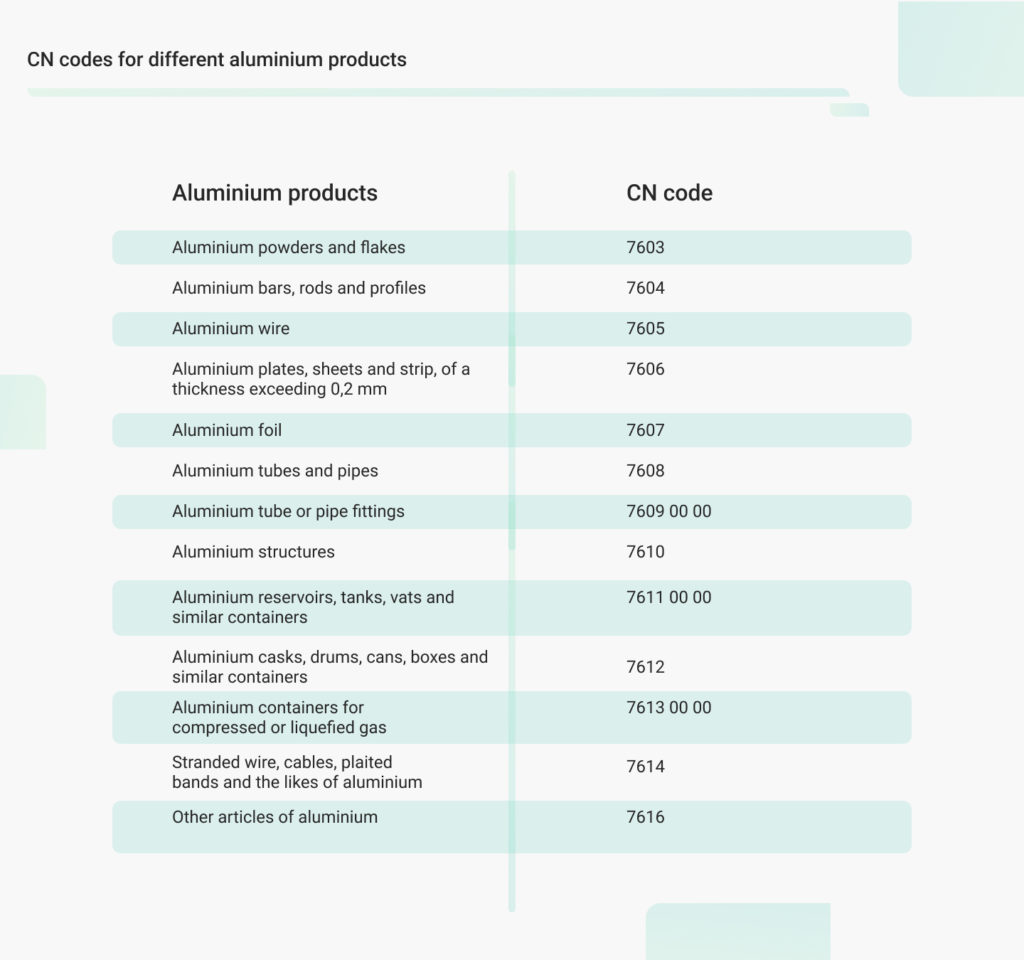

To make the process easy and transparent, the document assigns different CN codes to CBAM-qualified goods. Unwrought aluminium is represented by CN code 7601, and other aluminium products are represented by CN codes 7603 to 7616.

Specific items under aluminium products with CN code

Types of aluminium goods as per changing production routes

- Unwrought aluminium (CN code-7601): Unwrought aluminium is produced by multiple routes, including ‘primary aluminium’ for electrolytic smelting and ‘secondary aluminium’ by melting/recycling scrap. This is classified as a ‘simple good’ as the raw materials used in its manufacture are themselves considered to have zero embedded emissions.

- Aluminium products (7603 to 7616): These products fall under the category of complex goods since they have embedded emissions from the precursor unwrought aluminium.

Key production process and routes for aluminium sector

Like cement, there are multiple production routes and processes for the aluminium sector depending on its sub-categories. Here is a look at them:

- Unwrought aluminium – Primary (electrolytic) smelting production route: Primary aluminium is produced by the electrolysis of alumina in electrolytic cells. Direct emissions must be monitored for the primary (electrolytic) smelting production route. The CBAM Guidance document highlights that there are no precursors for this production route and process. Meanwhile, indirect emissions that result from electricity consumed by the production process should also be monitored.

- Unwrought aluminium – Secondary melting (recycling) production route: Secondary aluminium is produced from post-consumer aluminium scrap collected for recycling. The secondary aluminium is produced by gathering and sorting aluminium scrap from various sources like remelting and refining. Direct and indirect emissions are required to be monitored for this production route. Moreover, relevant precursors are also used in this production route.

- Aluminium products production process: Aluminium products are produced after processing precursors in the unwrought aluminium. They are produced by a variety of forming processes such as extrusion, casting, hot and cold rolling, forging and drawing. There should be monitoring done for the direct and indirect emissions for the aluminium products production route.

Aluminium sector-specific monitoring and reporting requirements

Direct and indirect embedded emissions need to be monitored in line with the methodology outlined in the Implementing Regulation and in section 6 of the guidance document. Other relevant emissions that need to be monitored and reported for the aluminium sector include:

- Emissions from the consumption of pre-baked carbon anodes or green anode paste during electrolysis

- Emissions from furnaces related to holding, pre-heating, re-melting and annealing

- Emissions from the production of measurable heating and cooling

- Emissions from emission control methods

During the definitive regime, reporting these ancillary emissions will become mandatory for all exporters and importers of aluminium products.

CBAM reporting for electricity sector

Electricity is a CBAM good with only one aggregated goods category and has only one greenhouse gas (GHG) associated, carbon dioxide (CO2) as it is the primary greenhouse gas emitted during electricity production. The Combined Nomenclature (CN) code for electrical energy is 2716 00 00, and only direct emissions are monitored under CBAM.

Parameters for electrical energy emissions quantification

Multiple rules and guidelines apply to electrical energy production when monitoring and quantifying emission data within the installation.

- Quantification of electrical energy: Electrical supplies should be metered for the purpose of determining the quantity of electricity consumed or produced by a production process. Metering should only be applied to the active power component consumed by the installation.

- Monitoring requirements: In order to monitor energy emissions, the operator should establish processes for direct and indirect emissions measurement of electricity consumed.

Which emissions to monitor in the electricity sector for CBAM

Only direct emissions of electricity are to be monitored under the CBAM guidelines. In order to determine the embedded emissions of electricity as imported goods, energy consumption at the installation level, raw materials and emissions from combustions are monitored. Embedded emissions if electricity imported to the EU are calculated by multiplying the amount of electricity with the respective emission factor. Moreover, for the calculation of emissions of electricity as CBAM goods, default values of emission factors can be used during the transitional period.

The reporting declarant is required to report information about the emission factor used for electricity, expressed as tonne CO2e per megawatt-hour (MWh). The reporting declarant also has to report on the data source or method used to determine the emission factor of electricity. These two are applicable when electricity is used as imported goods. Moreover, the report regarding the quantity of imported electricity, country of origin and all information related to direct emissions should be submitted.

Way forward for EU exporters of aluminium and electricity under CBAM reporting

Since various products are produced using different processes and routes in both the aluminium and electricity sectors, different monitoring methods and reporting requirements are applied to them. The reporting requirements also depend on sector-specific activities and change accordingly. The biggest challenge is to ensure accurate embedded emissions data for these sectors. However, CBAM reporting can be made efficient and easier with the help of advanced software like TSC NetZero. Its CBAM reporting tool provides precise data collection and accurate embedded emission calculations. Timely CBAM reporting also allows users to pre-configure data collection and reporting in a timely manner to avoid penalties.